GR-3 (Rev. 07-04)

(For Office Use Only)

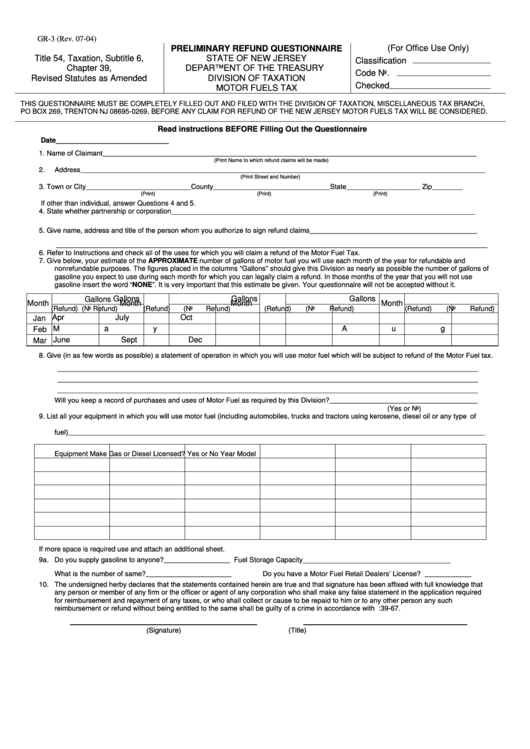

PRELIMINARY REFUND QUESTIONNAIRE

Title 54, Taxation, Subtitle 6,

STATE OF NEW JERSEY

Classification

Chapter 39,

DEPARTMENT OF THE TREASURY

Code No.

Revised Statutes as Amended

DIVISION OF TAXATION

Checked

MOTOR FUELS TAX

THIS QUESTIONNAIRE MUST BE COMPLETELY FILLED OUT AND FILED WITH THE DIVISION OF TAXATION, MISCELLANEOUS TAX BRANCH,

PO BOX 269, TRENTON NJ 08695-0269, BEFORE ANY CLAIM FOR REFUND OF THE NEW JERSEY MOTOR FUELS TAX WILL BE CONSIDERED.

Read instructions BEFORE Filling Out the Questionnaire

Date _____________________________

1.

Name of Claimant ________________________________________________________________________________________________

(Print Name to which refund claims will be made)

2.

Address ________________________________________________________________________________________________________

(Print Street and Number)

3.

Town or City ___________________________ County ______________________________ State ___________________ Zip ________

(Print)

(Print)

(Print)

If other than individual, answer Questions 4 and 5.

4.

State whether partnership or corporation ______________________________________________________________________________

5.

Give name, address and title of the person whom you authorize to sign refund claims ___________________________________________

___________________________________________________________________________________________________

6.

Refer to Instructions and check all of the uses for which you will claim a refund of the Motor Fuel Tax.

7.

Give below, your estimate of the APPROXIMATE number of gallons of motor fuel you will use each month of the year for refundable and

nonrefundable purposes. The figures placed in the columns “Gallons” should give this Division as nearly as possible the number of gallons of

gasoline you expect to use during each month for which you can legally claim a refund. In those months of the year that you will not use

gasoline insert the word “NONE”. It is very important that this estimate be given. Your questionnaire will not be accepted without it.

Gallons

Gallons

Gallons

Gallons

Month

Month

Month

Month

(Refund)

(No Refund)

(Refund)

(No Refund)

(Refund)

(No Refund)

(Refund)

(No Refund)

Apr

July

Oct

Jan

May

Aug

Nov

Feb

June

Sept

Dec

Mar

8.

Give (in as few words as possible) a statement of operation in which you will use motor fuel which will be subject to refund of the Motor Fuel tax.

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

Will you keep a record of purchases and uses of Motor Fuel as required by this Division? ______________________________________

(Yes or No)

9.

List all your equipment in which you will use motor fuel (including automobiles, trucks and tractors using kerosene, diesel oil or any type of

fuel) ___________________________________________________________________________________________________________

Equipment

Make

Gas or Diesel

Licensed? Yes or No

Year

Model

If more space is required use and attach an additional sheet.

9a. Do you supply gasoline to anyone? _________________

Fuel Storage Capacity ______________________________________

What is the number of same? ______________________

Do you have a Motor Fuel Retail Dealers’ License? ____________

10. The undersigned herby declares that the statements contained herein are true and that signature has been affixed with full knowledge that

any person or member of any firm or the officer or agent of any corporation who shall make any false statement in the application required

for reimbursement and repayment of any taxes, or who shall collect or cause to be repaid to him or to any other person any such

reimbursement or refund without being entitled to the same shall be guilty of a crime in accordance with N.J.S.A. 54:39-67.

(Signature)

(Title)

1

1 2

2