Ets Form 124 A - Non-Resident Contractor Sales And Use Tax Bond Covering A Single Contract - 2001

ADVERTISEMENT

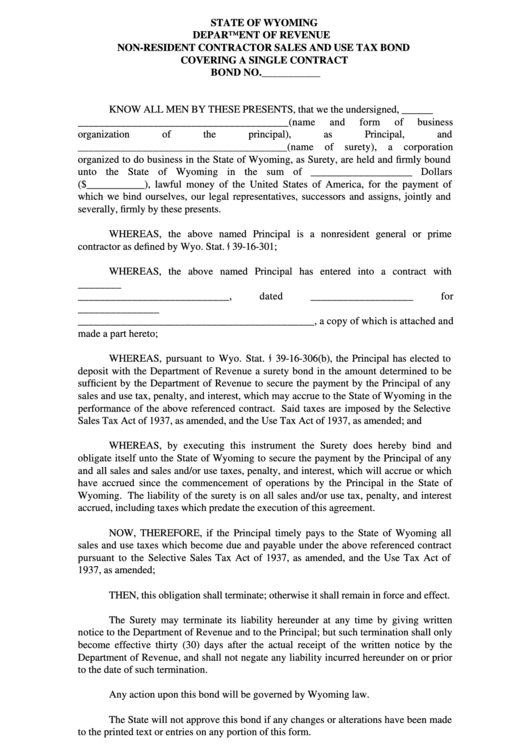

STATE OF WYOMING

DEPARTMENT OF REVENUE

NON-RESIDENT CONTRACTOR SALES AND USE TAX BOND

COVERING A SINGLE CONTRACT

BOND NO.___________

KNOW ALL MEN BY THESE PRESENTS, that we the undersigned, ______

_______________________________________(name

and

form

of

business

organization

of

the

principal),

as

Principal,

and

_______________________________________(name

of

surety),

a

corporation

organized to do business in the State of Wyoming, as Surety, are held and firmly bound

unto the State of Wyoming in the sum of ___________________ Dollars

($___________), lawful money of the United States of America, for the payment of

which we bind ourselves, our legal representatives, successors and assigns, jointly and

severally, firmly by these presents.

WHEREAS, the above named Principal is a nonresident general or prime

§

contractor as defined by Wyo. Stat.

39-16-301;

WHEREAS, the above named Principal has entered into a contract with

________

____________________________,

dated

___________________

for

_______________

____________________________________________, a copy of which is attached and

made a part hereto;

§

WHEREAS, pursuant to Wyo. Stat.

39-16-306(b), the Principal has elected to

deposit with the Department of Revenue a surety bond in the amount determined to be

sufficient by the Department of Revenue to secure the payment by the Principal of any

sales and use tax, penalty, and interest, which may accrue to the State of Wyoming in the

performance of the above referenced contract. Said taxes are imposed by the Selective

Sales Tax Act of 1937, as amended, and the Use Tax Act of 1937, as amended; and

WHEREAS, by executing this instrument the Surety does hereby bind and

obligate itself unto the State of Wyoming to secure the payment by the Principal of any

and all sales and sales and/or use taxes, penalty, and interest, which will accrue or which

have accrued since the commencement of operations by the Principal in the State of

Wyoming. The liability of the surety is on all sales and/or use tax, penalty, and interest

accrued, including taxes which predate the execution of this agreement.

NOW, THEREFORE, if the Principal timely pays to the State of Wyoming all

sales and use taxes which become due and payable under the above referenced contract

pursuant to the Selective Sales Tax Act of 1937, as amended, and the Use Tax Act of

1937, as amended;

THEN, this obligation shall terminate; otherwise it shall remain in force and effect.

The Surety may terminate its liability hereunder at any time by giving written

notice to the Department of Revenue and to the Principal; but such termination shall only

become effective thirty (30) days after the actual receipt of the written notice by the

Department of Revenue, and shall not negate any liability incurred hereunder on or prior

to the date of such termination.

Any action upon this bond will be governed by Wyoming law.

The State will not approve this bond if any changes or alterations have been made

to the printed text or entries on any portion of this form.

Non-Resident Contractor Sales and Use Tax Bond

__________________, Principal, and _________________,Surety

Bond No.________________

Page 1 of 2

ETS Form 124 a (Rev 5/8/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2