Form

Texas Comptroller of Public Accounts

50-142

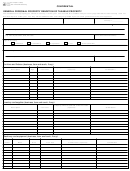

List all taxable personal property by category/type of property (example: business, farm and ranch, furniture, fixtures, inventory, supplies, machinery,

vehicles, etc.). You may attach additional sheets or a computer-generated document listing the information below, if necessary.

Vehicle Identification

Property Owner’s Estimate of

Property Description

Year/Age

Make/Model

Number

Market Value (optional)*

*NOTE: Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater than the rendered value is to

be submitted to the appraisal review board. Property owners may protest appraised values before the appraisal review board. (Tax Code Section 25.19)

Please indicate if you are filling out this form as:

Authorized Agent

Fiduciary

Secured Party

___________________________________________________________________________________________________

Name of Authorized Agent, Fiduciary or Secured Party

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

By checking this box, I affirm that the information contained in my most recent rendition statement filed for a prior tax year

______________

(the

tax year) continues to be complete and accurate for the current tax year.

Are you the property owner, an employee of the property owner or an employee of a property owner on behalf of an affiliated

entity of the property owner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Are you a secured party with a security interest in the property subject to this rendition and with a historical cost new of more than

$50,000, as defined and required by Tax Code Section 22.01(c-1) and (c-2)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If you checked “Yes” to this question, you must attach a document signed by the property owner, an employee of the property owner or an employee

on behalf of an affiliated entity of the property owner indicating consent for you to file the rendition

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct

to the best of your knowledge and belief.

If you checked “Yes” to either question above, sign and date on the first signature line below. No notarization is required.

___________________________________________________________________

___________________________________________________________________

_________________________

Date

If you checked “No” to the first question above, you must complete the following:

I swear that the information provided on this form is true and correct to the best of my knowledge and belief.

___________________________________________________________________

___________________________________________________________________

_________________________

Date

__________

____________________

_______

Subscribed and sworn before me this

day of

, 20

.

_____________________________________________________________________

Notary Public, State of Texas

comptroller.texas.gov/taxes/property-tax

Page 2

For more information, visit our website:

50-142 • 01-17/8

1

1 2

2 3

3