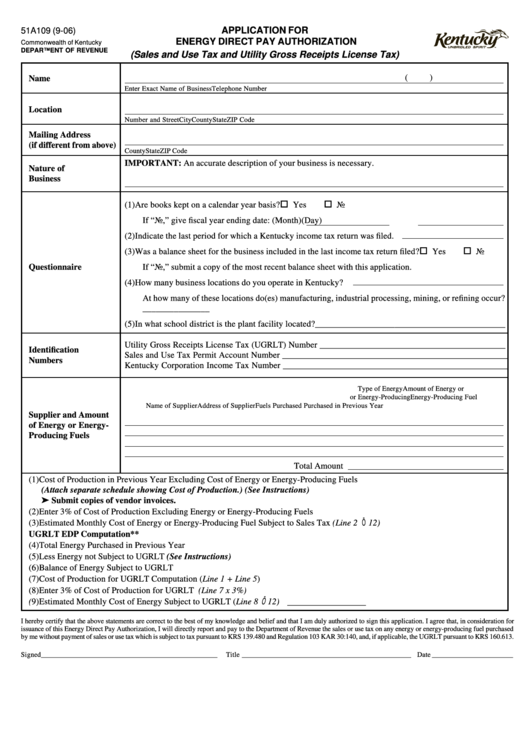

Form 51a109 - Application For Energy Direct Pay Authorization

ADVERTISEMENT

APPLICATION FOR

51A109 (9-06)

ENERGY DIRECT PAY AUTHORIZATION

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

(Sales and Use Tax and Utility Gross Receipts License Tax)

(

)

Name

Enter Exact Name of Business

Telephone Number

Location

Number and Street

City

County

State

ZIP Code

Mailing Address

(if different from above)

P.O. Box or Number and Street

City

County

State

ZIP Code

IMPORTANT: An accurate description of your business is necessary.

Nature of

Business

(1) Are books kept on a calendar year basis?

Yes

No

If “No,” give fiscal year ending date: (Month)

(Day)

(2) Indicate the last period for which a Kentucky income tax return was filed.

(3) Was a balance sheet for the business included in the last income tax return filed?

Yes

No

Questionnaire

If “No,” submit a copy of the most recent balance sheet with this application.

(4) How many business locations do you operate in Kentucky?

At how many of these locations do(es) manufacturing, industrial processing, mining, or refining occur?

_______________

(5) In what school district is the plant facility located?___________________________________________

Utility Gross Receipts License Tax (UGRLT) Number __________________________________________

Identification

Sales and Use Tax Permit Account Number ___________________________________________________

Numbers

Kentucky Corporation Income Tax Number ___________________________________________________

Type of Energy

Amount of Energy or

or Energy-Producing

Energy-Producing Fuel

Name of Supplier

Address of Supplier

Fuels Purchased

Purchased in Previous Year

Supplier and Amount

of Energy or Energy-

Producing Fuels

Total Amount

(1) Cost of Production in Previous Year Excluding Cost of Energy or Energy-Producing Fuels

(Attach separate schedule showing Cost of Production.) (See Instructions) .................................................. __________________

➤ Submit copies of vendor invoices.

(2) Enter 3% of Cost of Production Excluding Energy or Energy-Producing Fuels ................................................ __________________

(3) Estimated Monthly Cost of Energy or Energy-Producing Fuel Subject to Sales Tax (Line 2 Ö 12) ................. __________________

UGRLT EDP Computation**

(4) Total Energy Purchased in Previous Year ........................................................................................................... __________________

(5) Less Energy not Subject to UGRLT (See Instructions) ..................................................................................... __________________

(6) Balance of Energy Subject to UGRLT ................................................................................................................ __________________

(7) Cost of Production for UGRLT Computation (Line 1 + Line 5) ........................................................................ __________________

(8) Enter 3% of Cost of Production for UGRLT (Line 7 x 3% ) ............................................................................. __________________

(9) Estimated Monthly Cost of Energy Subject to UGRLT (Line 8 Ö 12) ................................................................

___________________________

I hereby certify that the above statements are correct to the best of my knowledge and belief and that I am duly authorized to sign this application. I agree that, in consideration for

issuance of this Energy Direct Pay Authorization, I will directly report and pay to the Department of Revenue the sales or use tax on any energy or energy-producing fuel purchased

by me without payment of sales or use tax which is subject to tax pursuant to KRS 139.480 and Regulation 103 KAR 30:140, and, if applicable, the UGRLT pursuant to KRS 160.613.

Signed __________________________________________________

Title ________________________________________________ Date _______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2