Form 21c - Statement To Correct Information Previously Submitted - 2012

ADVERTISEMENT

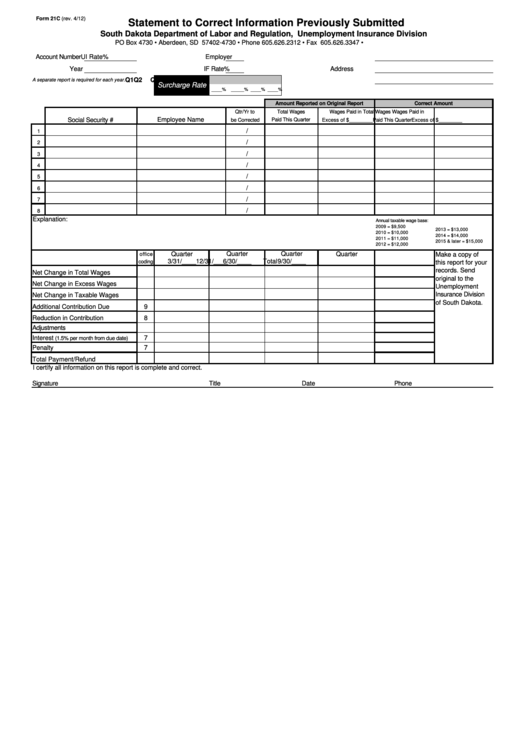

Form 21C (rev. 4/12)

Statement to Correct Information Previously Submitted

South Dakota Department of Labor and Regulation, Unemployment Insurance Division

PO Box 4730 • Aberdeen, SD 57402-4730 • Phone 605.626.2312 • Fax 605.626.3347 •

Account Number

UI Rate

%

Employer

Year

IF Rate

%

Address

Q1

Q2

Q3

Q4

A separate report is required for each year.

Surcharge Rate

____%

_____% ____% ____%

Amount Reported on Original Report

Correct Amount

Qtr/Yr to

Total Wages

Wages Paid in

Total Wages

Wages Paid in

Employee Name

Social Security #

be Corrected

Paid This Quarter

Excess of $________

Paid This Quarter

Excess of $________

/

1

/

2

/

3

/

4

/

5

/

6

/

7

/

8

Explanation:

Annual taxable wage base:

2009 = $9,500

2013 = $13,000

2010 = $10,000

2014 = $14,000

2011 = $11,000

2015 & later = $15,000

2012 = $12,000

Quarter

Quarter

Quarter

Quarter

office

Make a copy of

3/31/____

6/30/____

9/30/____

12/31/____

Total

coding

this report for your

records. Send

Net Change in Total Wages

original to the

Net Change in Excess Wages

Unemployment

Insurance Division

Net Change in Taxable Wages

of South Dakota.

Additional Contribution Due

9

Reduction in Contribution

8

Adjustments

Interest

7

(1.5% per month from due date)

Penalty

7

Total Payment/Refund

I certify all information on this report is complete and correct.

Signature

Title

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2