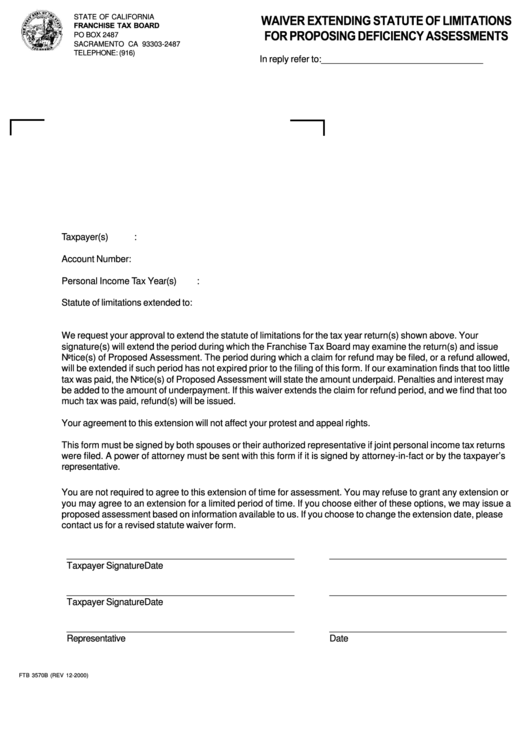

Ftb 3570b - Waiver Extending Statute Of Limitations For Proposing Deficiency Assessments Form

ADVERTISEMENT

WAIVER EXTENDING STATUTE OF LIMITATIONS

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

FOR PROPOSING DEFICIENCY ASSESSMENTS

PO BOX 2487

SACRAMENTO CA 93303-2487

TELEPHONE: (916)

In reply refer to:________________________________

Taxpayer(s)

:

Account Number :

Personal Income Tax Year(s)

:

Statute of limitations extended to :

We request your approval to extend the statute of limitations for the tax year return(s) shown above. Your

signature(s) will extend the period during which the Franchise Tax Board may examine the return(s) and issue

Notice(s) of Proposed Assessment. The period during which a claim for refund may be filed, or a refund allowed,

will be extended if such period has not expired prior to the filing of this form. If our examination finds that too little

tax was paid, the Notice(s) of Proposed Assessment will state the amount underpaid. Penalties and interest may

be added to the amount of underpayment. If this waiver extends the claim for refund period, and we find that too

much tax was paid, refund(s) will be issued.

Your agreement to this extension will not affect your protest and appeal rights.

This form must be signed by both spouses or their authorized representative if joint personal income tax returns

were filed. A power of attorney must be sent with this form if it is signed by attorney-in-fact or by the taxpayer’s

representative.

You are not required to agree to this extension of time for assessment. You may refuse to grant any extension or

you may agree to an extension for a limited period of time. If you choose either of these options, we may issue a

proposed assessment based on information available to us. If you choose to change the extension date, please

contact us for a revised statute waiver form.

_____________________________________________

___________________________________

Taxpayer Signature

Date

_____________________________________________

___________________________________

Taxpayer Signature

Date

_____________________________________________

___________________________________

Representative

Date

FTB 3570B (REV 12-2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1