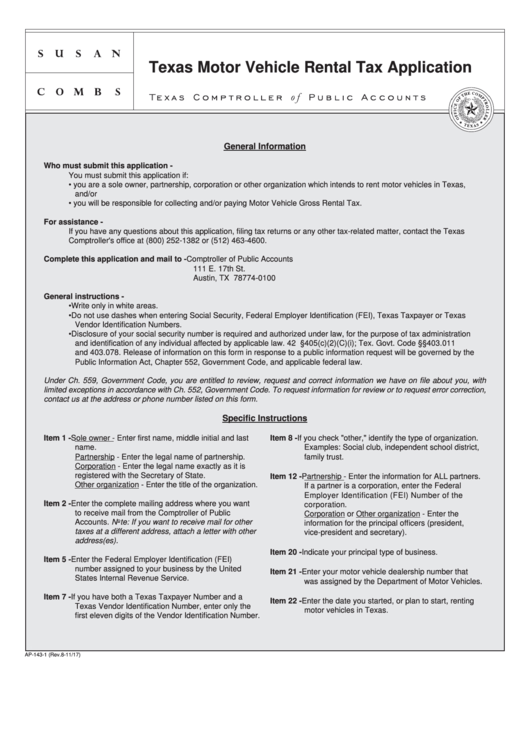

Texas Motor Vehicle Rental Tax Application

General Information

Who must submit this application -

You must submit this application if:

• you are a sole owner, partnership, corporation or other organization which intends to rent motor vehicles in Texas,

and/or

• you will be responsible for collecting and/or paying Motor Vehicle Gross Rental Tax.

For assistance -

If you have any questions about this application, filing tax returns or any other tax-related matter, contact the Texas

Comptroller's office at (800) 252-1382 or (512) 463-4600.

Complete this application and mail to - Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

General instructions -

• Write only in white areas.

• Do not use dashes when entering Social Security, Federal Employer Identification (FEI), Texas Taxpayer or Texas

Vendor Identification Numbers.

• Disclosure of your social security number is required and authorized under law, for the purpose of tax administration

and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011

and 403.078. Release of information on this form in response to a public information request will be governed by the

Public Information Act, Chapter 552, Government Code, and applicable federal law.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with

limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction,

contact us at the address or phone number listed on this form.

Specific Instructions

Item 1 - Sole owner - Enter first name, middle initial and last

Item 8 - If you check "other," identify the type of organization.

name.

Examples: Social club, independent school district,

Partnership - Enter the legal name of partnership.

family trust.

Corporation - Enter the legal name exactly as it is

registered with the Secretary of State.

Item 12 - Partnership - Enter the information for ALL partners.

Other organization - Enter the title of the organization.

If a partner is a corporation, enter the Federal

Employer Identification (FEI) Number of the

Item 2 - Enter the complete mailing address where you want

corporation.

to receive mail from the Comptroller of Public

Corporation or Other organization - Enter the

Accounts. Note: If you want to receive mail for other

information for the principal officers (president,

taxes at a different address, attach a letter with other

vice-president and secretary).

address(es).

Item 20 - Indicate your principal type of business.

Item 5 - Enter the Federal Employer Identification (FEI)

number assigned to your business by the United

Item 21 - Enter your motor vehicle dealership number that

States Internal Revenue Service.

was assigned by the Department of Motor Vehicles.

Item 7 - If you have both a Texas Taxpayer Number and a

Item 22 - Enter the date you started, or plan to start, renting

Texas Vendor Identification Number, enter only the

motor vehicles in Texas.

first eleven digits of the Vendor Identification Number.

AP-143-1 (Rev.8-11/17)

1

1 2

2 3

3