Proforma Invoice Form

Download a blank fillable Proforma Invoice Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Proforma Invoice Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

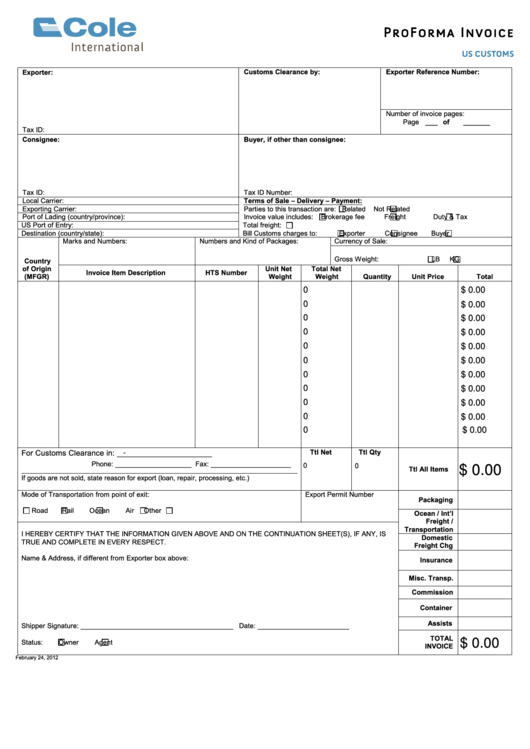

ProForma Invoice

US CUSTOMS

Customs Clearance by:

Exporter Reference Number:

Exporter:

Number of invoice pages:

Page _____

of

_______

Tax ID:

_____

__ of

Number:

Consignee:

Buyer, if other than consignee:

Tax ID:

Tax ID Number:

Number:

Local Carrier:

Terms of Sale – Delivery – Payment:

Exporting Carrier:

Parties to this transaction are:

Related

Not Related

Port of Lading (country/province):

Invoice value includes:

Brokerage fee

Freight

Duty & Tax

US Port of Entry:

Total freight:

charges:

Destination (country/state):

Bill Customs charges to:

Exporter

Consignee

Buyer

Marks and Numbers:

Numbers and Kind of Packages:

Currency of Sale:

Gross Weight:

LB

KG

Country

of Origin

Unit Net

Total Net

Invoice Item Description

HTS Number

(MFGR)

Weight

Weight

Quantity

Unit Price

Total

$ 0.00

0

0

$ 0.00

0

$ 0.00

0

$ 0.00

0

$ 0.00

0

$ 0.00

0

$ 0.00

0

$ 0.00

0

$ 0.00

0

$ 0.00

$ 0.00

0

For Customs Clearance in: ______________________

Ttl Net

Ttl Qty

-

Phone: ____________________ Fax: _____________________

0

0

$ 0.00

Ttl All Items

If goods are not sold, state reason for export (loan, repair, processing, etc.)

Mode of Transportation from point of exit:

Export Permit Number

Packaging

Road

Rail

Ocean

Air

Other

Ocean / Int’l

Freight /

Transportation

I HEREBY CERTIFY THAT THE INFORMATION GIVEN ABOVE AND ON THE CONTINUATION SHEET(S), IF ANY, IS

Domestic

TRUE AND COMPLETE IN EVERY RESPECT.

Freight Chg

Name & Address, if different from Exporter box above:

Insurance

Misc. Transp.

Commission

Container

Assists

Shipper Signature: ________________________________________ Date: ________________________

TOTAL

$ 0.00

Status:

Owner

Agent

INVOICE

February 24, 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2