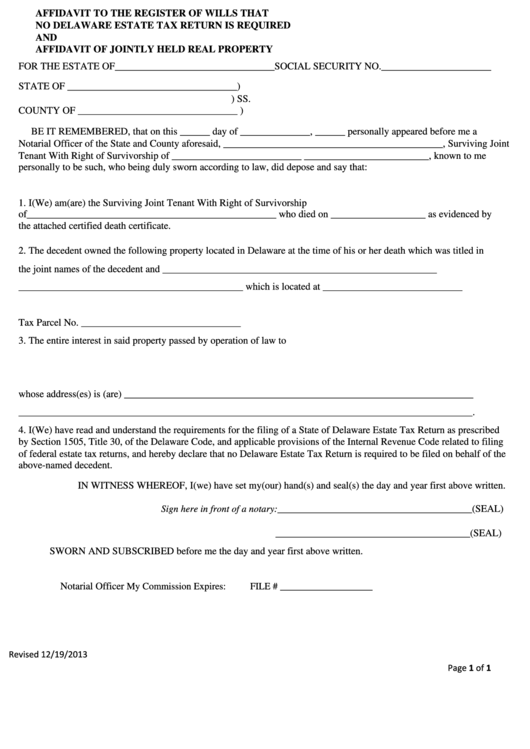

AFFIDAVIT TO THE REGISTER OF WILLS THAT

NO DELAWARE ESTATE TAX RETURN IS REQUIRED

AND

AFFIDAVIT OF JOINTLY HELD REAL PROPERTY

FOR THE ESTATE OF________________________________SOCIAL SECURITY NO.______________________

STATE OF __________________________________)

) SS.

COUNTY OF ________________________________ )

BE IT REMEMBERED, that on this ______ day of ______________, ______ personally appeared before me a

Notarial Officer of the State and County aforesaid, ____________________________________________, Surviving Joint

Tenant With Right of Survivorship of __________________________ _________________________, known to me

personally to be such, who being duly sworn according to law, did depose and say that:

1. I(We) am(are) the Surviving Joint Tenant With Right of Survivorship

of__________________________________________________ who died on ___________________ as evidenced by

the attached certified death certificate.

2. The decedent owned the following property located in Delaware at the time of his or her death which was titled in

the joint names of the decedent and _______________________________________________________

_____________________________________________ which is located at ____________________________

Tax Parcel No. ________________________________

3. The entire interest in said property passed by operation of law to

whose address(es) is (are) ______________________________________________________________________

___________________________________________________________________________________________.

4. I(We) have read and understand the requirements for the filing of a State of Delaware Estate Tax Return as prescribed

by Section 1505, Title 30, of the Delaware Code, and applicable provisions of the Internal Revenue Code related to filing

of federal estate tax returns, and hereby declare that no Delaware Estate Tax Return is required to be filed on behalf of the

above-named decedent.

IN WITNESS WHEREOF, I(we) have set my(our) hand(s) and seal(s) the day and year first above written.

Sign here in front of a notary: _______________________________________(SEAL)

_______________________________________(SEAL)

SWORN AND SUBSCRIBED before me the day and year first above written.

Notarial Officer My Commission Expires:

FILE # ___________________

Revised 12/19/2013

Page 1 of 1

1

1