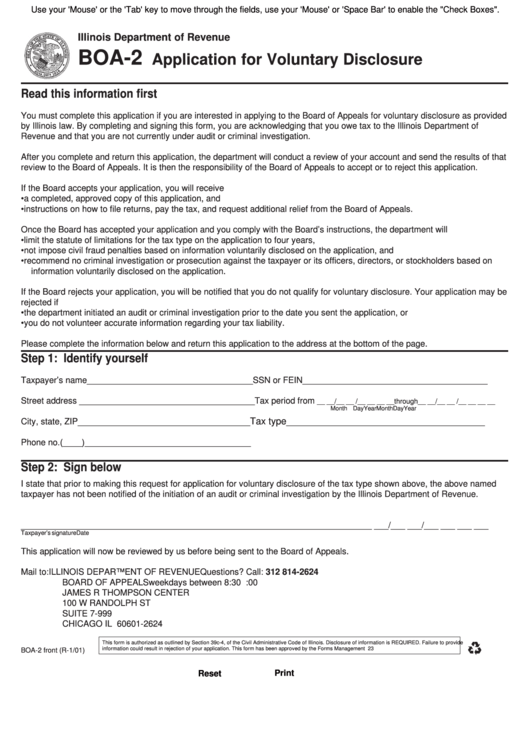

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

BOA-2

Application for Voluntary Disclosure

Read this information first

You must complete this application if you are interested in applying to the Board of Appeals for voluntary disclosure as provided

by Illinois law. By completing and signing this form, you are acknowledging that you owe tax to the Illinois Department of

Revenue and that you are not currently under audit or criminal investigation.

After you complete and return this application, the department will conduct a review of your account and send the results of that

review to the Board of Appeals. It is then the responsibility of the Board of Appeals to accept or to reject this application.

If the Board accepts your application, you will receive

• a completed, approved copy of this application, and

• instructions on how to file returns, pay the tax, and request additional relief from the Board of Appeals.

Once the Board has accepted your application and you comply with the Board’s instructions, the department will

• limit the statute of limitations for the tax type on the application to four years,

• not impose civil fraud penalties based on information voluntarily disclosed on the application, and

• recommend no criminal investigation or prosecution against the taxpayer or its officers, directors, or stockholders based on

information voluntarily disclosed on the application.

If the Board rejects your application, you will be notified that you do not qualify for voluntary disclosure. Your application may be

rejected if

• the department initiated an audit or criminal investigation prior to the date you sent the application, or

• you do not volunteer accurate information regarding your tax liability.

Please complete the information below and return this application to the address at the bottom of the page.

Step 1: Identify yourself

Taxpayer’s name ___________________________________

SSN or FEIN _______________________________________

Street address _____________________________________

Tax period from

__ __/__ __ /__ __ __ __through__ __/__ __ /__ __ __ __

Month Day

Year

Month

Day

Year

_________________________________

Tax type ______________________________________

City, state, ZIP

Phone no. (____)___________________________________

Step 2: Sign below

I state that prior to making this request for application for voluntary disclosure of the tax type shown above, the above named

taxpayer has not been notified of the initiation of an audit or criminal investigation by the Illinois Department of Revenue.

_______________________________________________________________________

___ ___/___ ___/___ ___ ___ ___

Taxpayer’s signature

Date

This application will now be reviewed by us before being sent to the Board of Appeals.

Mail to:

ILLINOIS DEPARTMENT OF REVENUE

Questions? Call: 312 814-2624

BOARD OF APPEALS

weekdays between 8:30 a.m. and 5:00 p.m.

JAMES R THOMPSON CENTER

100 W RANDOLPH ST

SUITE 7-999

CHICAGO IL 60601-2624

This form is authorized as outlined by Section 39c-4, of the Civil Administrative Code of Illinois. Disclosure of information is REQUIRED. Failure to provide

information could result in rejection of your application. This form has been approved by the Forms Management Center.

IL-492-3223

BOA-2 front (R-1/01)

Reset

Print

1

1 2

2