Dr-261 7/06 - Application For Refund - Intangible Personal Property Tax Form - Florida Department Of Revenue

ADVERTISEMENT

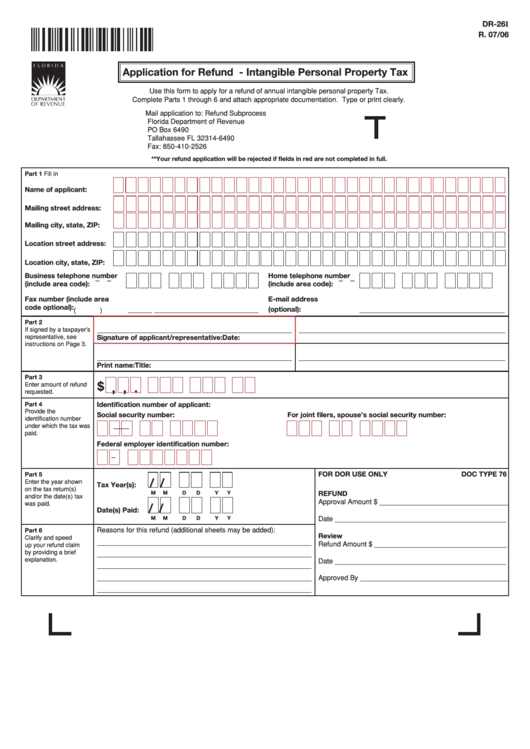

DR-26I

R. 07/06

Application for Refund - Intangible Personal Property Tax

Use this form to apply for a refund of annual intangible personal property Tax.

Complete Parts 1 through 6 and attach appropriate documentation. Type or print clearly.

Mail application to:

Refund Subprocess

Florida Department of Revenue

PO Box 6490

Tallahassee FL 32314-6490

Fax: 850-410-2526

**Your refund application will be rejected if fields in red are not completed in full.

Part 1 Fill in

Name of applicant:

Mailing street address:

Mailing city, state, ZIP:

Location street address:

Location city, state, ZIP:

Business telephone number

Home telephone number

–

–

–

–

(include area code):

(include area code):

Fax number (include area

E-mail address

code optional):

(optional):

(

)

Part 2

If signed by a taxpayer’s

representative, see

Signature of applicant/representative:

Date:

instructions on Page 3.

Print name:

Title:

Part 3

$

Enter amount of refund

,

,

.

requested.

Part 4

Identification number of applicant:

Provide the

Social security number:

For joint filers, spouse’s social security number:

identification number

under which the tax was

–

–

–

–

paid.

Federal employer identification number:

–

FOR DOR USE ONLY

DOC TYPE 76

Part 5

/

/

Enter the year shown

Tax Year(s):

on the tax return(s)

REFUND

M

M

D

D

Y

Y

and/or the date(s) tax

Approval Amount $ _________________________________

was paid.

/

/

Date(s) Paid:

M

M

D

D

Y

Y

Date ____________________________________________

Reasons for this refund (additional sheets may be added):

Part 6

Review

Clarify and speed

Refund Amount $ __________________________________

up your refund claim

by providing a brief

explanation.

Date ____________________________________________

Approved By ______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1