Monthly Report - Prepared Food And Beverage Form - Virginia Commissioner Of The Revenue

ADVERTISEMENT

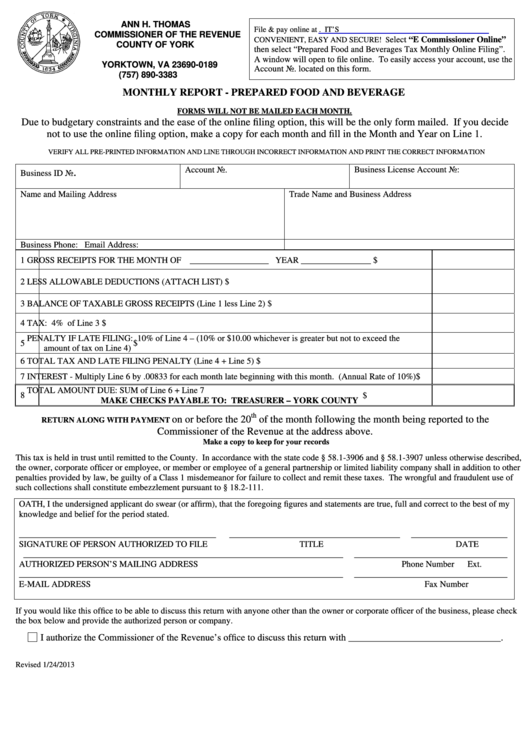

ANN H. THOMAS

File & pay online at IT’S

COMMISSIONER OF THE REVENUE

elect “E Commissioner Online”

CONVENIENT, EASY AND SECURE! S

COUNTY OF YORK

then select “Prepared Food and Beverages Tax Monthly Online Filing”.

P.O. BOX 189

A window will open to file online. To easily access your account, use the

YORKTOWN, VA 23690-0189

Account No. located on this form.

(757) 890-3383

MONTHLY REPORT - PREPARED FOOD AND BEVERAGE

FORMS WILL NOT BE MAILED EACH MONTH.

Due to budgetary constraints and the ease of the online filing option, this will be the only form mailed. If you decide

not to use the online filing option, make a copy for each month and fill in the Month and Year on Line 1.

VERIFY ALL PRE-PRINTED INFORMATION AND LINE THROUGH INCORRECT INFORMATION AND PRINT THE CORRECT INFORMATION

Account No.

Business License Account No:

.

Business ID No

Name and Mailing Address

Trade Name and Business Address

Business Phone:

Email Address:

1

GROSS RECEIPTS FOR THE MONTH OF __________________ YEAR ________________

$

2

LESS ALLOWABLE DEDUCTIONS (ATTACH LIST)

$

3

BALANCE OF TAXABLE GROSS RECEIPTS (Line 1 less Line 2)

$

4

TAX: 4% of Line 3

$

PENALTY IF LATE FILING: 10% of Line 4 – (10% or $10.00 whichever is greater but not to exceed the

5

$

amount of tax on Line 4)

6

TOTAL TAX AND LATE FILING PENALTY (Line 4 + Line 5)

$

7

INTEREST - Multiply Line 6 by .00833 for each month late beginning with this month. (Annual Rate of 10%)

$

TOTAL AMOUNT DUE: SUM of Line 6 + Line 7

8

$

MAKE CHECKS PAYABLE TO: TREASURER – YORK COUNTY

th

on or before the 20

of the month following the month being reported to the

RETURN ALONG WITH PAYMENT

Commissioner of the Revenue at the address above.

Make a copy to keep for your records

This tax is held in trust until remitted to the County. In accordance with the state code § 58.1-3906 and § 58.1-3907 unless otherwise described,

the owner, corporate officer or employee, or member or employee of a general partnership or limited liability company shall in addition to other

penalties provided by law, be guilty of a Class 1 misdemeanor for failure to collect and remit these taxes. The wrongful and fraudulent use of

such collections shall constitute embezzlement pursuant to § 18.2-111.

OATH, I the undersigned applicant do swear (or affirm), that the foregoing figures and statements are true, full and correct to the best of my

knowledge and belief for the period stated.

_____________________________________________

_______________________________________

______________________

SIGNATURE OF PERSON AUTHORIZED TO FILE

TITLE

DATE

_________________________________________________________________________

___________________________________

AUTHORIZED PERSON’S MAILING ADDRESS

Phone Number

Ext.

__________________________________________________________________________

___________________________________

E-MAIL ADDRESS

Fax Number

If you would like this office to be able to discuss this return with anyone other than the owner or corporate officer of the business, please check

the box below and provide the authorized person or company.

I authorize the Commissioner of the Revenue’s office to discuss this return with ________________________________.

Revised 1/24/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1