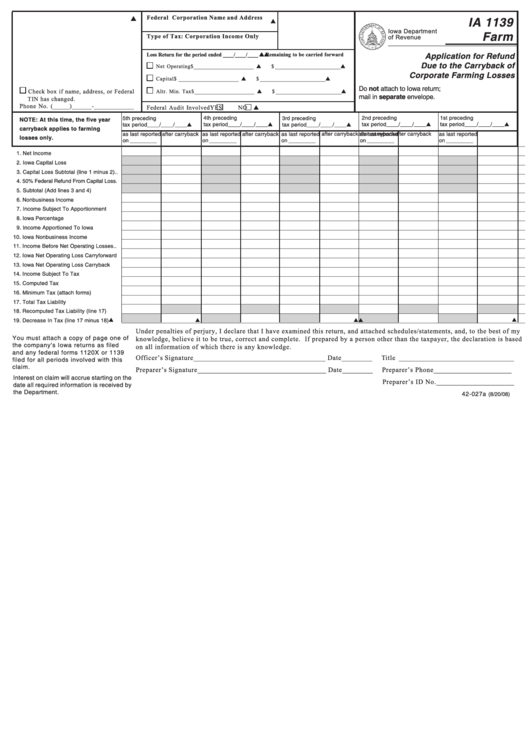

Corporation Name and Address

Federal T.I.N.

IA 1139

Iowa Department

Farm

Type of Tax: Corporation Income Only

of Revenue

Loss Return for the period ended ____/____/____

Remaining to be carried forward

Application for Refund

Due to the Carryback of

Net Operating $ ______________________

$ ________________________

Corporate Farming Losses

Capital

$ ______________________

$ ________________________

Do not attach to Iowa return;

Check box if name, address, or Federal

Altr. Min. Tax $ ______________________

$ ________________________

mail in separate envelope.

TIN has changed.

Phone No. (_____)______-____________

Federal Audit Involved

YES

NO

5th preceding

4th preceding

3rd preceding

2nd preceding

1st preceding

NOTE: At this time, the five year

tax period____/____/____

tax period____/____/____

tax period____/____/____

tax period____/____/____

tax period____/____/____

carryback applies to farming

as last reported

after carryback

as last reported

after carryback

as last reported

after carryback

as last reported

after carryback

as last reported

after carryback

losses only.

on _________

on _________

on _________

on _________

on _________

____________________________________________________________________________________________________________________________________________________

1. Net Income ............................................

____________________________________________________________________________________________________________________________________________________

2. Iowa Capital Loss ..................................

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

3. Capital Loss Subtotal (line 1 minus 2) ..

4. 50% Federal Refund From Capital Loss .

____________________________________________________________________________________________________________________________________________________

5. Subtotal (Add lines 3 and 4) ..................

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

6. Nonbusiness Income .............................

7. Income Subject To Apportionment .......

____________________________________________________________________________________________________________________________________________________

8. Iowa Percentage ....................................

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

9. Income Apportioned To Iowa ................

10. Iowa Nonbusiness Income ...................

____________________________________________________________________________________________________________________________________________________

11. Income Before Net Operating Losses ..

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

12. Iowa Net Operating Loss Carryforward

13. Iowa Net Operating Loss Carryback ....

____________________________________________________________________________________________________________________________________________________

14. Income Subject To Tax .........................

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

15. Computed Tax ......................................

16. Minimum Tax (attach forms) ................

____________________________________________________________________________________________________________________________________________________

17. Total Tax Liability ..................................

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

18. Recomputed Tax Liability (line 17) ......

19. Decrease In Tax (line 17 minus 18) .....

____________________________________________________________________________________________________________________________________________________

Under penalties of perjury, I declare that I have examined this return, and attached schedules/statements, and, to the best of my

You must attach a copy of page one of

knowledge, believe it to be true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based

the company’s Iowa returns as filed

on all information of which there is any knowledge.

and any federal forms 1120X or 1139

Officer’s Signature _______________________________________ Date _________

Title __________________________________

filed for all periods involved with this

claim.

Preparer’s Signature ______________________________________ Date _________

Preparer’s Phone _______________________

Interest on claim will accrue starting on the

Preparer’s ID No. _______________________

date all required information is received by

the Department.

Reset Form

42-027a

(8/20/08)

1

1