Election Change Form For The Health Savings Account (Hsa) Form

ADVERTISEMENT

P.O. Box 43653 Louisville, KY 40253-0653 (502) 244-1161 (800) 919-BMSI

FAX (502) 244-1162

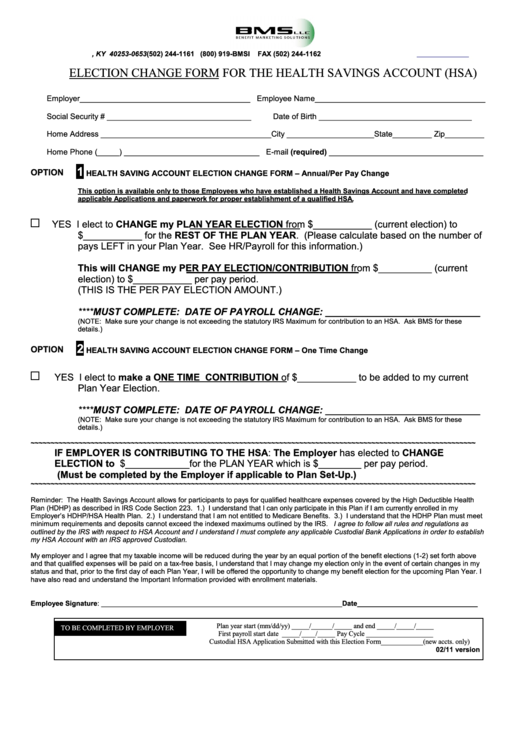

ELECTION CHANGE FORM FOR THE HEALTH SAVINGS ACCOUNT (HSA)

Employer_______________________________________ Employee Name_______________________________________

Social Security # _________________________________

Date of Birth ___________________________________

Home Address _______________________________________City ____________________State_________ Zip_________

Home Phone (_____) _______________________________ E-mail (required) ___________________________________

1

OPTION

HEALTH SAVING ACCOUNT ELECTION CHANGE FORM – Annual/Per Pay Change

This option is available only to those Employees who have established a Health Savings Account and have completed

applicable Applications and paperwork for proper establishment of a qualified HSA.

YES I elect to CHANGE my PLAN YEAR ELECTION from $___________ (current election) to

$___________ for the REST OF THE PLAN YEAR. (Please calculate based on the number of

pays LEFT in your Plan Year. See HR/Payroll for this information.)

This will CHANGE my PER PAY ELECTION/CONTRIBUTION from $__________ (current

election) to $___________ per pay period.

(THIS IS THE PER PAY ELECTION AMOUNT.)

****MUST COMPLETE: DATE OF PAYROLL CHANGE: _____________________________

(NOTE: Make sure your change is not exceeding the statutory IRS Maximum for contribution to an HSA. Ask BMS for these

details.)

2

OPTION

HEALTH SAVING ACCOUNT ELECTION CHANGE FORM – One Time Change

YES I elect to make a ONE TIME CONTRIBUTION of $___________ to be added to my current

Plan Year Election.

****MUST COMPLETE: DATE OF PAYROLL CHANGE: _____________________________

(NOTE: Make sure your change is not exceeding the statutory IRS Maximum for contribution to an HSA. Ask BMS for these

details.)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

IF EMPLOYER IS CONTRIBUTING TO THE HSA: The Employer has elected to CHANGE

ELECTION to $____________for the PLAN YEAR which is $________ per pay period.

(Must be completed by the Employer if applicable to Plan Set-Up.)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Reminder: The Health Savings Account allows for participants to pays for qualified healthcare expenses covered by the High Deductible Health

Plan (HDHP) as described in IRS Code Section 223. 1.) I understand that I can only participate in this Plan if I am currently enrolled in my

Employer’s HDHP/HSA Health Plan. 2.) I understand that I am not entitled to Medicare Benefits. 3.) I understand that the HDHP Plan must meet

minimum requirements and deposits cannot exceed the indexed maximums outlined by the IRS.

I agree to follow all rules and regulations as

outlined by the IRS with respect to HSA Account and I understand I must complete any applicable Custodial Bank Applications in order to establish

my HSA Account with an IRS approved Custodian.

My employer and I agree that my taxable income will be reduced during the year by an equal portion of the benefit elections (1-2) set forth above

and that qualified expenses will be paid on a tax-free basis, I understand that I may change my election only in the event of certain changes in my

status and that, prior to the first day of each Plan Year, I will be offered the opportunity to change my benefit election for the upcoming Plan Year. I

have also read and understand the Important Information provided with enrollment materials.

Employee Signature: ______________________________________________________________Date_______________________________

Plan year start (mm/dd/yy) _____/______/_____ and end _____/_____/_____

TO BE COMPLETED BY EMPLOYER

First payroll start date _____/____/_____ Pay Cycle ___________________

;OYER

Custodial HSA Application Submitted with this Election Form____________(new accts. only)

02/11 version

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1