Clear Form

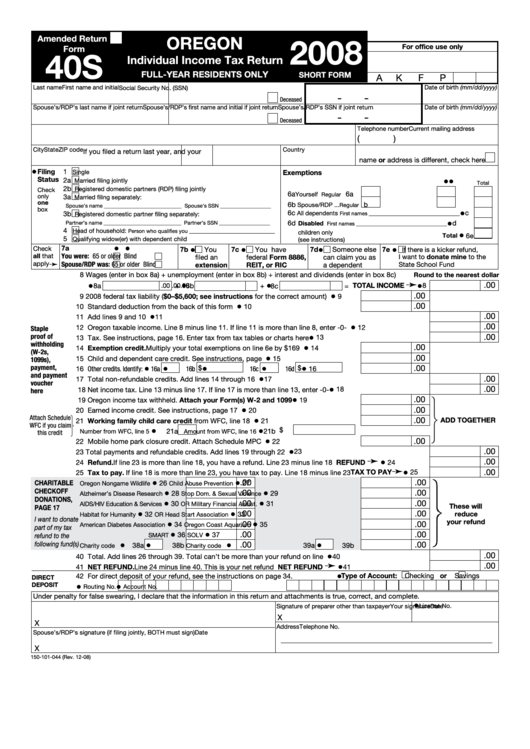

OREGON

2008

Amended Return

For office use only

Form

40S

Individual Income Tax Return

FULL-YEAR RESIDENTS ONLY

SHORT FORM

A

K

F

P

Last name

First name and initial

Date of birth (mm/dd/yyyy)

Social Security No. (SSN)

–

–

Deceased

Spouse’s/RDP’s last name if joint return

Spouse’s/RDP’s first name and initial if joint return Spouse’s/RDP’s SSN if joint return

Date of birth (mm/dd/yyyy)

–

–

Deceased

Current mailing address

Telephone number

(

)

City

State

ZIP code

Country

If you filed a return last year, and your

name or address is different, check here

•

Filing

1

Single

Exemptions

Status

•

•

2a

Married filing jointly

Total

2b

Registered domestic partners (RDP) filing jointly

Check

6a

6a

Yourself ...........

Regular

...... Severely disabled

....

only

3a

Married filing separately:

one

6b

b

Spouse/RDP ...

Regular

...... Severely disabled

......

Spouse’s name _____________________________ Spouse’s SSN ___________________

box

•

3b

Registered domestic partner filing separately:

6c

c

All dependents

First names __________________________________

Partner’s name _____________________________ Partner’s SSN ___________________

•

6d

d

Disabled

First names __________________________________

4

Head of household:

Person who qualifies you ________________________________

children only

•

Total

6e

5

Qualifying widow(er) with dependent child

(see instructions)

•

•

•

•

•

•

Check

7a

7b

You

7c

You have

7d

Someone else

7e

If there is a kicker refund,

all that

You were:

65 or older

Blind

filed an

federal Form 8886,

can claim you as

I want to donate mine to the

apply

➛

Spouse/RDP was:

65 or older

Blind

extension

REIT, or RIC

a dependent

State School Fund

8 Wages (enter in box 8a) + unemployment (enter in box 8b) + interest and dividends (enter in box 8c)

Round to the nearest dollar

➛

•

•

•

•

.00

= TOTAL INCOME

8

8a

.00

+

8b

.00

+

8c

.00

•

.00

9 2008 federal tax liability ($0–$5,600; see instructions for the correct amount) .......

9

•

.00

10 Standard deduction from the back of this form .........................................................

10

•

.00

11 Add lines 9 and 10 .........................................................................................................................................

11

•

.00

12 Oregon taxable income. Line 8 minus line 11. If line 11 is more than line 8, enter -0- ..................................

12

Staple

•

proof of

.00

13 Tax. See instructions, page 16. Enter tax from tax tables or charts here ......................................................

13

withholding

•

.00

14 Exemption credit. Multiply your total exemptions on line 6e by $169 .....................

14

(W-2s,

•

.00

15 Child and dependent care credit. See instructions, page 16.....................................

15

1099s),

•

payment,

•

•

•

•

.00

16b $

16d $

16 Other credits. Identify:

16a

16c

16

and payment

•

.00

17 Total non-refundable credits. Add lines 14 through 16 .................................................................................

17

voucher

•

.00

18 Net income tax. Line 13 minus line 17. If line 17 is more than line 13, enter -0- ...........................................

18

here

•

.00

19 Oregon income tax withheld. Attach your Form(s) W-2 and 1099 .........................

19

•

.00

20 Earned income credit. See instructions, page 17 ......................................................

20

Attach Schedule

•

.00

ADD TOGETHER

21 Working family child care credit from WFC, line 18 ...............................................

21

WFC if you claim

•

•

21b $

21a

Number from WFC, line 5

Amount from WFC, line 16

this credit

•

.00

22 Mobile home park closure credit. Attach Schedule MPC ..........................................

22

•

.00

23

23 Total payments and refundable credits. Add lines 19 through 22 .................................................................

➛

•

.00

24 Refund. If line 23 is more than line 18, you have a refund. Line 23 minus line 18 ................. REFUND

24

➛

•

.00

25 Tax to pay. If line 18 is more than line 23, you have tax to pay. Line 18 minus line 23 .... TAX TO PAY

25

•

•

.00

.00

CHARITAbLE

26

27

Oregon Nongame Wildlife

Child Abuse Prevention

CHECkOFF

•

•

.00

.00

28

29

Alzheimer’s Disease Research

Stop Dom. & Sexual Violence

DONATIONS,

•

•

.00

.00

30

31

AIDS/HIV Education & Services

OR Military Financial Assist.

These will

PAGE 17

•

•

.00

.00

32

33

reduce

Habitat for Humanity

OR Head Start Association

I want to donate

your refund

•

•

.00

.00

34

35

American Diabetes Association

Oregon Coast Aquarium

part of my tax

•

•

.00

.00

36

37

refund to the

SMART

SOLV

•

•

•

•

following fund(s)

.00

.00

38a

38b

39a

39b

Charity code

Charity code

•

.00

40 Total. Add lines 26 through 39. Total can’t be more than your refund on line 24..........................................

40

➛

•

.00

41 NET REFUND. Line 24 minus line 40. This is your net refund ....................................... NET REFUND

41

•

Type of Account:

Checking or

42 For direct deposit of your refund, see the instructions on page 34.

Savings

DIRECT

•

•

DEPOSIT

Routing No.

Account No.

Under penalty for false swearing, I declare that the information in this return and attachments is true, correct, and complete.

•

License No.

Your signature

Date

Signature of preparer other than taxpayer

X

X

Address

Telephone No.

Spouse’s/RDP’s signature (if filing jointly, BOTH must sign)

Date

X

150-101-044 (Rev. 12-08)

1

1 2

2