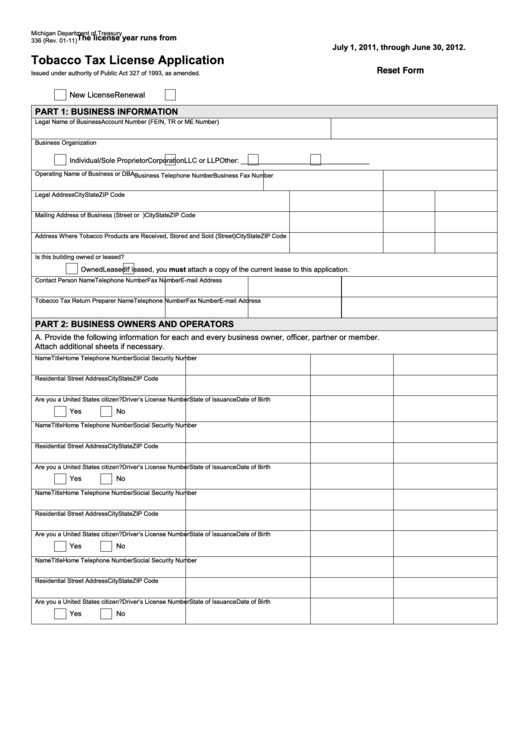

Michigan Department of Treasury

The license year runs from

336 (Rev. 01-11)

July 1, 2011, through June 30, 2012.

Tobacco Tax License Application

Reset Form

Issued under authority of Public Act 327 of 1993, as amended.

New License

Renewal

PART 1: BUSINESS INFORMATION

Legal Name of Business

Account Number (FEIN, TR or ME Number)

Business Organization

Individual/Sole Proprietor

Corporation

LLC or LLP

Other: _________________________________

Operating Name of Business or DBA

Business Telephone Number

Business Fax Number

Legal Address

City

State

ZIP Code

Mailing Address of Business (Street or P.O. Box)

City

State

ZIP Code

Address Where Tobacco Products are Received, Stored and Sold (Street)

City

State

ZIP Code

Is this building owned or leased?

Owned

Leased

If leased, you must attach a copy of the current lease to this application.

Contact Person Name

Telephone Number

Fax Number

E-mail Address

Tobacco Tax Return Preparer Name

Telephone Number

Fax Number

E-mail Address

PART 2: BUSINESS OWNERS AND OPERATORS

A. Provide the following information for each and every business owner, officer, partner or member.

Attach additional sheets if necessary.

Name

Title

Home Telephone Number

Social Security Number

Residential Street Address

City

State

ZIP Code

Are you a United States citizen?

Driver’s License Number

State of Issuance

Date of Birth

Yes

No

Name

Title

Home Telephone Number

Social Security Number

Residential Street Address

City

State

ZIP Code

Are you a United States citizen?

Driver’s License Number

State of Issuance

Date of Birth

Yes

No

Name

Title

Home Telephone Number

Social Security Number

Residential Street Address

City

State

ZIP Code

Are you a United States citizen?

Driver’s License Number

State of Issuance

Date of Birth

Yes

No

Name

Title

Home Telephone Number

Social Security Number

Residential Street Address

City

State

ZIP Code

Are you a United States citizen?

Driver’s License Number

State of Issuance

Date of Birth

Yes

No

1

1 2

2 3

3 4

4 5

5