Salary Reduction/allocation Agreement Form

ADVERTISEMENT

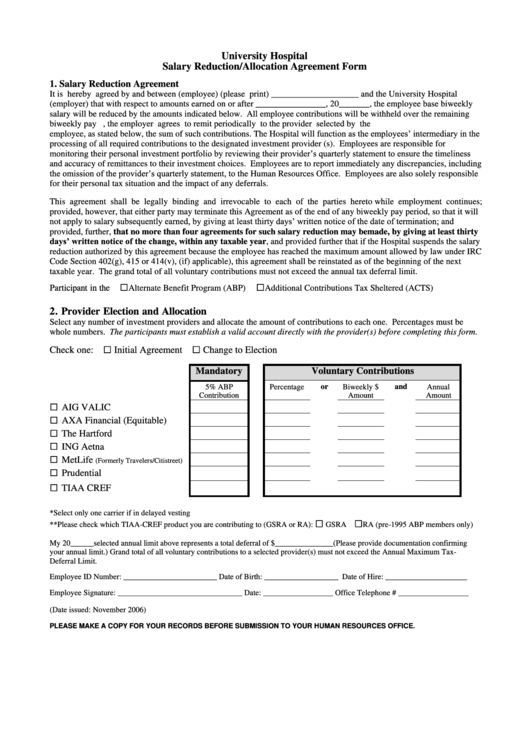

University Hospital

Salary Reduction/Allocation Agreement Form

1. Salary Reduction Agreement

It is hereby agreed by and between (employee) (please print) ____________________ and the University Hospital

(employer) that with respect to amounts earned on or after ________________, 20_______, the employee base biweekly

salary will be reduced by the amounts indicated below. All employee contributions will be withheld over the remaining

biweekly pay periods. At the same time, the employer agrees to remit periodically to the provider selected by the

employee, as stated below, the sum of such contributions. The Hospital will function as the employees’ intermediary in the

processing of all required contributions to the designated investment provider (s).

Employees are responsible for

monitoring their personal investment portfolio by reviewing their provider’s quarterly statement to ensure the timeliness

and accuracy of remittances to their investment choices. Employees are to report immediately any discrepancies, including

the omission of the provider’s quarterly statement, to the Human Resources Office. Employees are also solely responsible

for their personal tax situation and the impact of any deferrals.

This agreement shall be legally binding and irrevocable to each of the parties hereto while employment continues;

provided, however, that either party may terminate this Agreement as of the end of any biweekly pay period, so that it will

not apply to salary subsequently earned, by giving at least thirty days’ written notice of the date of termination; and

provided, further, that no more than four agreements for such salary reduction may be made, by giving at least thirty

days’ written notice of the change, within any taxable year, and provided further that if the Hospital suspends the salary

reduction authorized by this agreement because the employee has reached the maximum amount allowed by law under IRC

Code Section 402(g), 415 or 414(v), (if) applicable), this agreement shall be reinstated as of the beginning of the next

taxable year. The grand total of all voluntary contributions must not exceed the annual tax deferral limit.

Participant in the

Alternate Benefit Program (ABP)

Additional Contributions Tax Sheltered (ACTS)

2. Provider Election and Allocation

Select any number of investment providers and allocate the amount of contributions to each one. Percentages must be

whole numbers. The participants must establish a valid account directly with the provider(s) before completing this form.

Check one:

Initial Agreement

Change to Election

Mandatory

Voluntary Contributions

5% ABP

Percentage

or

Biweekly $

and

Annual

Contribution

Amount

Amount

AIG VALIC

AXA Financial (Equitable)

The Hartford

ING Aetna

MetLife

(Formerly Travelers/Citistreet)

Prudential

TIAA CREF

*Select only one carrier if in delayed vesting

**Please check which TIAA-CREF product you are contributing to (GSRA or RA):

GSRA

RA (pre-1995 ABP members only)

My 20______selected annual limit above represents a total deferral of $_______________(Please provide documentation confirming

your annual limit.) Grand total of all voluntary contributions to a selected provider(s) must not exceed the Annual Maximum Tax-

Deferral Limit.

Employee ID Number: ________________________ Date of Birth: ___________________ Date of Hire: _____________________

Employee Signature: ________________________________ Date: __________________ Office Telephone # __________________

(Date issued: November 2006)

PLEASE MAKE A COPY FOR YOUR RECORDS BEFORE SUBMISSION TO YOUR HUMAN RESOURCES OFFICE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2