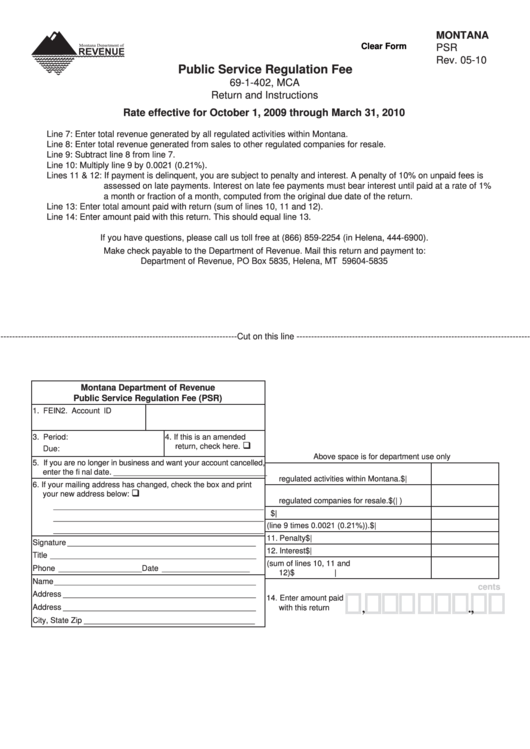

MONTANA

Clear Form

PSR

Rev. 05-10

Public Service Regulation Fee

69-1-402, MCA

Return and Instructions

Rate effective for October 1, 2009 through March 31, 2010

Line 7:

Enter total revenue generated by all regulated activities within Montana.

Line 8:

Enter total revenue generated from sales to other regulated companies for resale.

Line 9:

Subtract line 8 from line 7.

Line 10:

Multiply line 9 by 0.0021 (0.21%).

Lines 11 & 12: If payment is delinquent, you are subject to penalty and interest. A penalty of 10% on unpaid fees is

assessed on late payments. Interest on late fee payments must bear interest until paid at a rate of 1%

a month or fraction of a month, computed from the original due date of the return.

Line 13:

Enter total amount paid with return (sum of lines 10, 11 and 12).

Line 14:

Enter amount paid with this return. This should equal line 13.

If you have questions, please call us toll free at (866) 859-2254 (in Helena, 444-6900).

Make check payable to the Department of Revenue. Mail this return and payment to:

Department of Revenue, PO Box 5835, Helena, MT 59604-5835

--------------------------------------------------------------------------------- Cut on this line --------------------------------------------------------------------------------

Montana Department of Revenue

Public Service Regulation Fee (PSR)

1. FEIN

2. Account ID

3. Period:

4. If this is an amended

return, check here.

Due:

Above space is for department use only

5. If you are no longer in business and want your account cancelled,

7. Gross operating revenue generated by all

enter the fi nal date. ___________________________________

regulated activities within Montana.

$

|

6. If your mailing address has changed, check the box and print

8. Gross revenues from sales to other

your new address below:

regulated companies for resale.

$(

|

)

________________________________________________

9. Total - subtract line 8 from line 7.

$

|

________________________________________________

10. Fee due (line 9 times 0.0021 (0.21%)).

$

|

________________________________________________

11. Penalty

$

|

Signature ___________________________________________

12. Interest

$

|

Title _______________________________________________

13. Total amount due (sum of lines 10, 11 and

Phone ___________________ Date ____________________

12)

$

|

Name ______________________________________________

cents

Address ____________________________________________

14. Enter amount paid

Address ____________________________________________

with this return

,

,

.

City, State Zip _______________________________________

1

1