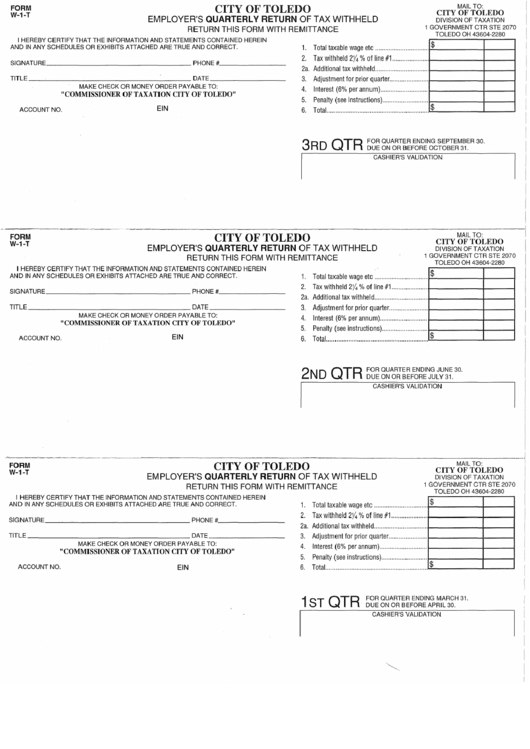

FORM

W-1-T

CITY OF TOLEDO

MAIL TO:

CITY OF TOLEDO

DIVISION OF TAXATION

EMPLOYER'S QUARTERLY RETURN OF TAX WITHHELD

RETURN THIS FORM WITH REMITTANCE

1 GOVERNMENT CTR STE 2070

TOLEDO OH 43604-2280

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS CONTAINED HEREIN

AND IN ANY SCHEDULES OR EXHIBITS ATTACHED ARE TRUE AND CORRECT.

SIGNATURE _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ P H O N E # · - - - - - - -

T I T L E _ - - - ' - - - - - - - - - - - - - - - - DATE _ _ _ _ _ _ _ _

MAKE CHECK OR MONEY ORDER PAYABLE TO:

"COMMISSIONER OF TAXATION CITY OF TOLEDO"

ACCOUNT NO.

$

1. Total taxable wage etc ................................

~-----+-----!

2. Tax withheld 2%% of line #1 .....................

- t - - - - - - + - - - - t

2a. Additional tax withheld ................................

t - - - - - - - f - - - - 1

3. Adjustment for prior quarter .......................

t - - - - - - - + - - - - 1

4.

Interest (6% per annum) ............................

t - - - - - - - + - - - - 1

5.

Penalty (see instructions) ...........................

r.-------+----1

6. Total. ............................................................

~..:$

_ _ _ _ _ .__ _ __.

3RD QTR

FOR QUARTER ENDING SEPTEMBER 30.

DUE ON OR BEFORE OCTOBER 31.

CASHIER'S VALIDATION

FORM

W-1-T

CITY OF TOLEDO

MAIL TO:

CITY OF TOLEDO

DIVISION OF TAXATION

EMPLOYER'S QUARTERLY RETURN OF TAX WITHHELD

RETURN THIS FORM WITH REMITTANCE

1 GOVERNMENT CTR STE 2070

TOLEDO OH 43604-2280

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS CONTAINED HEREIN

AND IN ANY SCHEDULES OR EXHIBITS ATTACHED ARE TRUE AND CORRECT.

SIGNATURE _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ PHONE#· _ _ _ _ _ _ _

TITLE _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ DATE _ _ _ _ _ _ _ _

MAKE CHECK OR MONEY ORDER PAYABLE TO:

"COMMISSIONER OF TAXATION CITY OF TOLEDO"

ACCOUNT NO.

1. Total taxable wage etc .............................. .

$

2. Tax withheld 2%% of line #1 .................... .

2a. Additional tax withheld .............................. .

3. Adjustment for prior quarter .................... ..

4.

Interest (6% per annum) .......................... ..

5. Penalty (see instructions) ........................ ..

6. Total .......................................................... .

$

2ND QTR

FOR QUARTER ENDING JUNE 30.

DUE ON OR BEFORE JULY 31.

CASHIER'S VALIDATION

FORM

W-1-T

CITY OF TOLEDO

MAIL TO:

CITY OF TOLEDO

DIVISION OF TAXATION

EMPLOYER'S QUARTERLY RETURN OF TAX WITHHELD

RETURN THIS FORM WITH REMITTANCE

1 GOVERNMENT CTR STE 2070

TOLEDO OH 43604-2280

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS CONTAINED HEREIN

AND IN ANY SCHEDULES OR EXHIBITS ATTACHED ARE TRUE AND CORRECT.

SIGNATURE_~---'-------------

PHONE#. _ _ _ _ _ _ _

TITLE _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ DATE _ _ _ _ _ _ _ _

MAKE CHECK OR MONEY ORDER PAYABLE TO:

"COMMISSIONER OF TAXATION CITY OF TOLEDO"

ACCOUNT NO.

$

1. Total taxable wage etc ................................

1 - - - - - - - + - - - - t

2. Tax withheld 2%% of line #1 .....................

+-------+----1

2a. Additional tax withheld ................................

J - - - - - - - + - - - - 1

3. Adjustment for prior quarter .......................

l - - - - - - - + - - - - 1

4.

Interest (6% per annum) ............................

I-------+----!

5.

Penalty (see instructions) ...........................

J - - - - - - - 1 - - - - - t

6. Total ............................................................

~-:.$

_ _ _ _ ____,.__ _ ____,

1ST

QTR

FOR QUARTER ENDING MARCH 31.

DUE ON OR BEFORE APRIL 30.

CASHIER'S VALIDATION

EIN

EIN

EIN

1

1 2

2