Reset Form

Print Form

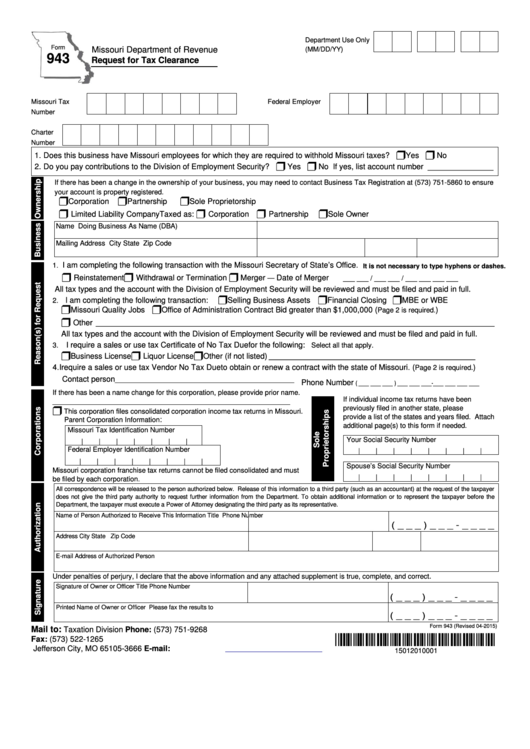

Department Use Only

Form

Missouri Department of Revenue

(MM/DD/YY)

943

Request for Tax Clearance

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Charter

Number

r

r

1. Does this business have Missouri employees for which they are required to withhold Missouri taxes?

Yes

No

r

r

2. Do you pay contributions to the Division of Employment Security?

Yes

No If yes, list account number _______________

If there has been a change in the ownership of your business, you may need to contact Business Tax Registration at (573) 751-5860 to ensure

your account is property registered.

r

r

r

Corporation

Partnership

Sole Proprietorship

r

r

r

r

Limited Liability Company Taxed as:

Corporation

Partnership

Sole Owner

Name

Doing Business As Name (DBA)

Mailing Address

City

State

Zip Code

I am completing the following transaction with the Missouri Secretary of State’s Office.

1.

It is not necessary to type hyphens or dashes.

r

r

r

Reinstatement

Withdrawal or Termination

Merger

Date of Merger

—

___ ___ / ___ ___ / ___ ___ ___ ___

All tax types and the account with the Division of Employment Security will be reviewed and must be filed and paid in full.

r

r

r

I am completing the following transaction:

Selling Business Assets

Financial Closing

MBE or WBE

2.

r

r

Missouri Quality Jobs

Office of Administration Contract Bid greater than $1,000,000 (

)

Page 2 is required.

r

Other ___________________________________________________________________________________________

All tax types and the account with the Division of Employment Security will be reviewed and must be filed and paid in full.

I require a sales or use tax Certificate of No Tax Due for the following:

3.

Select all that apply.

r

r

r

Business License

Liquor License

Other (if not listed)

_____________________________________________________

4. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. (

)

Page 2 is required.

Contact person

______________________________________________

Phone Number

( ___ ___ ___ ) ___ ___ ___-___ ___ ___ ___

If there has been a name change for this corporation, please provide prior name.

If individual income tax returns have been

_____________________________________________________________

r

previously filed in another state, please

This corporation files consolidated corporation income tax returns in Missouri.

provide a list of the states and years filed. Attach

:

Parent Corporation Information

additional page(s) to this form if needed.

Missouri Tax Identification Number

Your Social Security Number

|

|

|

|

|

|

|

Federal Employer Identification Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social Security Number

Missouri corporation franchise tax returns cannot be filed consolidated and must

|

|

|

|

|

|

|

|

be filed by each corporation.

All correspondence will be released to the person authorized below. Release of this information to a third party (such as an accountant) at the request of the taxpayer

does not give the third party authority to request further information from the Department. To obtain additional information or to represent the taxpayer before the

Department, the taxpayer must execute a Power of Attorney designating the third party as its representative.

Name of Person Authorized to Receive This Information

Title

Phone Number

( _ _ _ ) _

_ _ - _ _

_ _

Address

City

State

Zip Code

E-mail Address of Authorized Person

.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct

Signature of Owner or Officer

Title

Phone Number

( _ _ _ ) _ _ _ - _ _ _ _

Printed Name of Owner or Officer

Please fax the results to

( _ _ _ ) _ _ _ - _ _ _ _

Form 943 (Revised 04-2015)

Mail to:

Taxation Division

Phone: (573) 751-9268

*15012010001*

P.O. Box 3666

Fax: (573) 522-1265

Jefferson City, MO 65105-3666

E-mail:

taxclearance@dor.mo.gov

15012010001

1

1 2

2