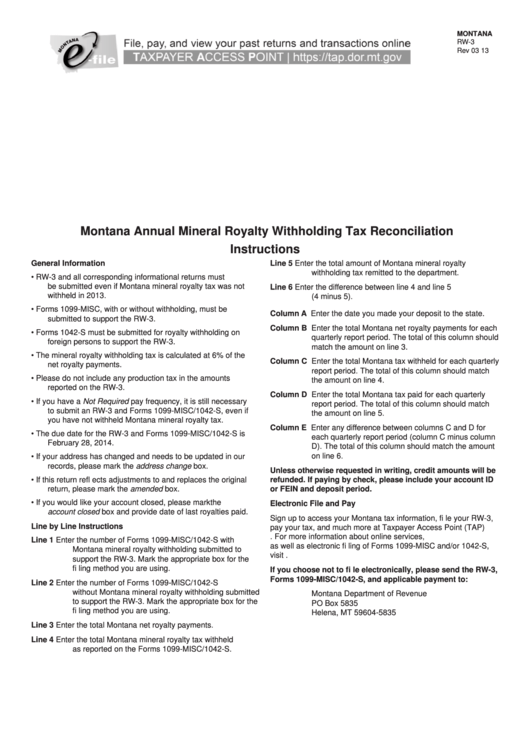

MONTANA

RW-3

Rev 03 13

Montana Annual Mineral Royalty Withholding Tax Reconciliation

Instructions

General Information

Line 5

Enter the total amount of Montana mineral royalty

withholding tax remitted to the department.

•

RW-3 and all corresponding informational returns must

be submitted even if Montana mineral royalty tax was not

Line 6

Enter the difference between line 4 and line 5

withheld in 2013.

(4 minus 5).

•

Forms 1099-MISC, with or without withholding, must be

Column A Enter the date you made your deposit to the state.

submitted to support the RW-3.

Column B Enter the total Montana net royalty payments for each

•

Forms 1042-S must be submitted for royalty withholding on

quarterly report period. The total of this column should

foreign persons to support the RW-3.

match the amount on line 3.

•

The mineral royalty withholding tax is calculated at 6% of the

Column C Enter the total Montana tax withheld for each quarterly

net royalty payments.

report period. The total of this column should match

•

Please do not include any production tax in the amounts

the amount on line 4.

reported on the RW-3.

Column D Enter the total Montana tax paid for each quarterly

•

If you have a Not Required pay frequency, it is still necessary

report period. The total of this column should match

to submit an RW-3 and Forms 1099-MISC/1042-S, even if

the amount on line 5.

you have not withheld Montana mineral royalty tax.

Column E Enter any difference between columns C and D for

•

The due date for the RW-3 and Forms 1099-MISC/1042-S is

each quarterly report period (column C minus column

February 28, 2014.

D). The total of this column should match the amount

on line 6.

•

If your address has changed and needs to be updated in our

records, please mark the address change box.

Unless otherwise requested in writing, credit amounts will be

•

If this return refl ects adjustments to and replaces the original

refunded. If paying by check, please include your account ID

return, please mark the amended box.

or FEIN and deposit period.

•

If you would like your account closed, please mark the

Electronic File and Pay

account closed box and provide date of last royalties paid.

Sign up to access your Montana tax information, fi le your RW-3,

Line by Line Instructions

pay your tax, and much more at Taxpayer Access Point (TAP)

https://tap.dor.mt.gov. For more information about online services,

Line 1

Enter the number of Forms 1099-MISC/1042-S with

as well as electronic fi ling of Forms 1099-MISC and/or 1042-S,

Montana mineral royalty withholding submitted to

visit revenue.mt.gov.

support the RW-3. Mark the appropriate box for the

fi ling method you are using.

If you choose not to fi le electronically, please send the RW-3,

Forms 1099-MISC/1042-S, and applicable payment to:

Line 2

Enter the number of Forms 1099-MISC/1042-S

without Montana mineral royalty withholding submitted

Montana Department of Revenue

to support the RW-3. Mark the appropriate box for the

PO Box 5835

fi ling method you are using.

Helena, MT 59604-5835

Line 3

Enter the total Montana net royalty payments.

Line 4

Enter the total Montana mineral royalty tax withheld

as reported on the Forms 1099-MISC/1042-S.

1

1 2

2