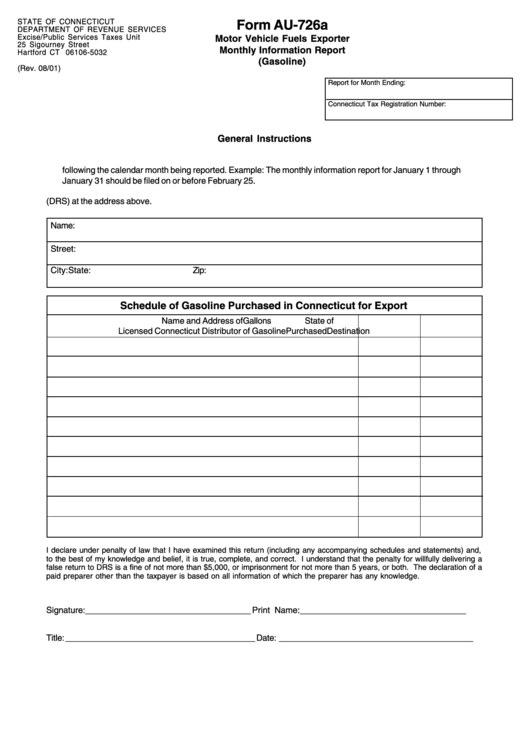

Form Au-726a - Motor Vehicle Fuels Exporter Monthly Information Report Form (Gasoline)

ADVERTISEMENT

STATE OF CONNECTICUT

Form AU-726a

DEPARTMENT OF REVENUE SERVICES

Excise/Public Services Taxes Unit

Motor Vehicle Fuels Exporter

25 Sigourney Street

Monthly Information Report

Hartford CT 06106-5032

(Gasoline)

(Rev. 08/01)

Report for Month Ending:

Connecticut Tax Registration Number:

General Instructions

1. This report must be filed with the Commissioner of Revenue Services not later than the 25th day of the month

following the calendar month being reported. Example: The monthly information report for January 1 through

January 31 should be filed on or before February 25.

2. Mail to the Department of Revenue Services (DRS) at the address above.

Name:

Street:

City:

State:

Zip:

Schedule of Gasoline Purchased in Connecticut for Export

Name and Address of

Gallons

State of

Licensed Connecticut Distributor of Gasoline

Purchased

Destination

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and,

to the best of my knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a

false return to DRS is a fine of not more than $5,000, or imprisonment for not more than 5 years, or both. The declaration of a

paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature: ___________________________________ Print Name: ___________________________________

Title: ________________________________________ Date: _________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1