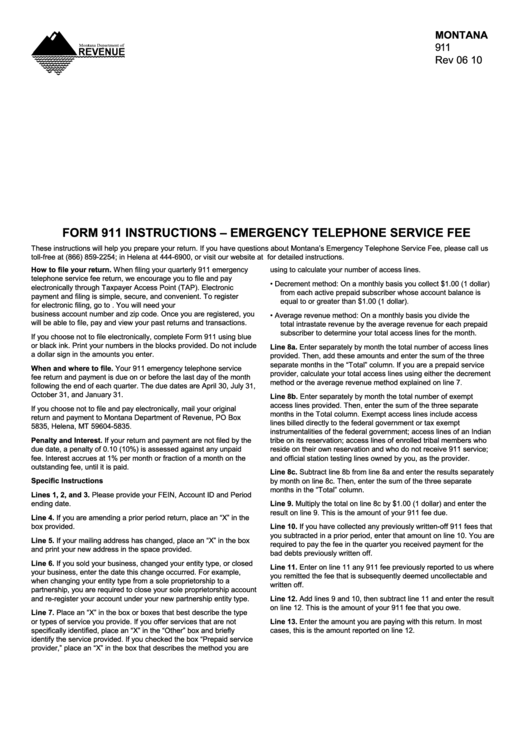

MONTANA

911

Rev 06 10

FORM 911 INSTRUCTIONS – EMERGENCY TELEPHONE SERVICE FEE

These instructions will help you prepare your return. If you have questions about Montana’s Emergency Telephone Service Fee, please call us

toll-free at (866) 859-2254; in Helena at 444-6900, or visit our website at revenue.mt.gov for detailed instructions.

How to file your return. When filing your quarterly 911 emergency

using to calculate your number of access lines.

telephone service fee return, we encourage you to file and pay

•

Decrement method: On a monthly basis you collect $1.00 (1 dollar)

electronically through Taxpayer Access Point (TAP). Electronic

from each active prepaid subscriber whose account balance is

payment and filing is simple, secure, and convenient. To register

equal to or greater than $1.00 (1 dollar).

for electronic filing, go to https://tap.dor.mt.gov. You will need your

business account number and zip code. Once you are registered, you

•

Average revenue method: On a monthly basis you divide the

will be able to file, pay and view your past returns and transactions.

total intrastate revenue by the average revenue for each prepaid

subscriber to determine your total access lines for the month.

If you choose not to file electronically, complete Form 911 using blue

or black ink. Print your numbers in the blocks provided. Do not include

Line 8a. Enter separately by month the total number of access lines

a dollar sign in the amounts you enter.

provided. Then, add these amounts and enter the sum of the three

separate months in the “Total” column. If you are a prepaid service

When and where to file. Your 911 emergency telephone service

provider, calculate your total access lines using either the decrement

fee return and payment is due on or before the last day of the month

method or the average revenue method explained on line 7.

following the end of each quarter. The due dates are April 30, July 31,

October 31, and January 31.

Line 8b. Enter separately by month the total number of exempt

access lines provided. Then, enter the sum of the three separate

If you choose not to file and pay electronically, mail your original

months in the Total column. Exempt access lines include access

return and payment to Montana Department of Revenue, PO Box

lines billed directly to the federal government or tax exempt

5835, Helena, MT 59604-5835.

instrumentalities of the federal government; access lines of an Indian

Penalty and Interest. If your return and payment are not filed by the

tribe on its reservation; access lines of enrolled tribal members who

due date, a penalty of 0.10 (10%) is assessed against any unpaid

reside on their own reservation and who do not receive 911 service;

fee. Interest accrues at 1% per month or fraction of a month on the

and official station testing lines owned by you, as the provider.

outstanding fee, until it is paid.

Line 8c. Subtract line 8b from line 8a and enter the results separately

Specific Instructions

by month on line 8c. Then, enter the sum of the three separate

months in the “Total” column.

Lines 1, 2, and 3. Please provide your FEIN, Account ID and Period

ending date.

Line 9. Multiply the total on line 8c by $1.00 (1 dollar) and enter the

result on line 9. This is the amount of your 911 fee due.

Line 4. If you are amending a prior period return, place an “X” in the

Line 10. If you have collected any previously written-off 911 fees that

box provided.

you subtracted in a prior period, enter that amount on line 10. You are

Line 5. If your mailing address has changed, place an “X” in the box

required to pay the fee in the quarter you received payment for the

and print your new address in the space provided.

bad debts previously written off.

Line 6. If you sold your business, changed your entity type, or closed

Line 11. Enter on line 11 any 911 fee previously reported to us where

your business, enter the date this change occurred. For example,

you remitted the fee that is subsequently deemed uncollectable and

when changing your entity type from a sole proprietorship to a

written off.

partnership, you are required to close your sole proprietorship account

and re-register your account under your new partnership entity type.

Line 12. Add lines 9 and 10, then subtract line 11 and enter the result

on line 12. This is the amount of your 911 fee that you owe.

Line 7. Place an “X” in the box or boxes that best describe the type

or types of service you provide. If you offer services that are not

Line 13. Enter the amount you are paying with this return. In most

specifically identified, place an “X” in the “Other” box and briefly

cases, this is the amount reported on line 12.

identify the service provided. If you checked the box “Prepaid service

provider,” place an “X” in the box that describes the method you are

1

1 2

2