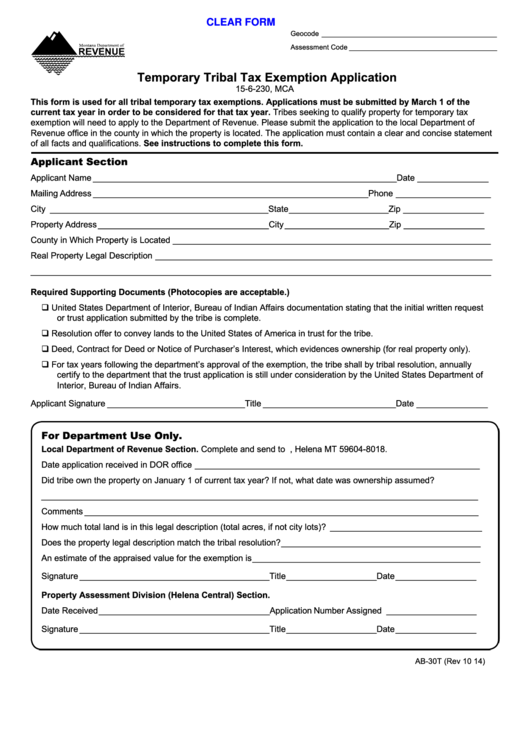

CLEAR FORM

Geocode _____________________________________________

Assessment Code ______________________________________

Temporary Tribal Tax Exemption Application

15-6-230, MCA

This form is used for all tribal temporary tax exemptions. Applications must be submitted by March 1 of the

current tax year in order to be considered for that tax year. Tribes seeking to qualify property for temporary tax

exemption will need to apply to the Department of Revenue. Please submit the application to the local Department of

Revenue office in the county in which the property is located. The application must contain a clear and concise statement

of all facts and qualifications. See instructions to complete this form.

Applicant Section

Applicant Name ________________________________________________________________ Date _______________

Mailing Address __________________________________________________________ Phone ____________________

City ______________________________________________ State _____________________ Zip _________________

Property Address ____________________________________ City ______________________ Zip _________________

County in Which Property is Located ___________________________________________________________________

Real Property Legal Description _______________________________________________________________________

_________________________________________________________________________________________________

Required Supporting Documents (Photocopies are acceptable.)

q United States Department of Interior, Bureau of Indian Affairs documentation stating that the initial written request

or trust application submitted by the tribe is complete.

q Resolution offer to convey lands to the United States of America in trust for the tribe.

q Deed, Contract for Deed or Notice of Purchaser’s Interest, which evidences ownership (for real property only).

q For tax years following the department’s approval of the exemption, the tribe shall by tribal resolution, annually

certify to the department that the trust application is still under consideration by the United States Department of

Interior, Bureau of Indian Affairs.

Applicant Signature _____________________________ Title ____________________________ Date _______________

For Department Use Only.

Local Department of Revenue Section. Complete and send to P.O. Box 8018, Helena MT 59604-8018.

Date application received in DOR office ____________________________________________________________

Did tribe own the property on January 1 of current tax year? If not, what date was ownership assumed?

____________________________________________________________________________________________

Comments ___________________________________________________________________________________

How much total land is in this legal description (total acres, if not city lots)? ________________________________

Does the property legal description match the tribal resolution? __________________________________________

An estimate of the appraised value for the exemption is ________________________________________________

Signature ________________________________________ Title ___________________Date _________________

Property Assessment Division (Helena Central) Section.

Date Received ____________________________________ Application Number Assigned ___________________

Signature ________________________________________ Title ___________________Date _________________

AB-30T (Rev 10 14)

1

1 2

2