Reset Form

Print and Reset Form

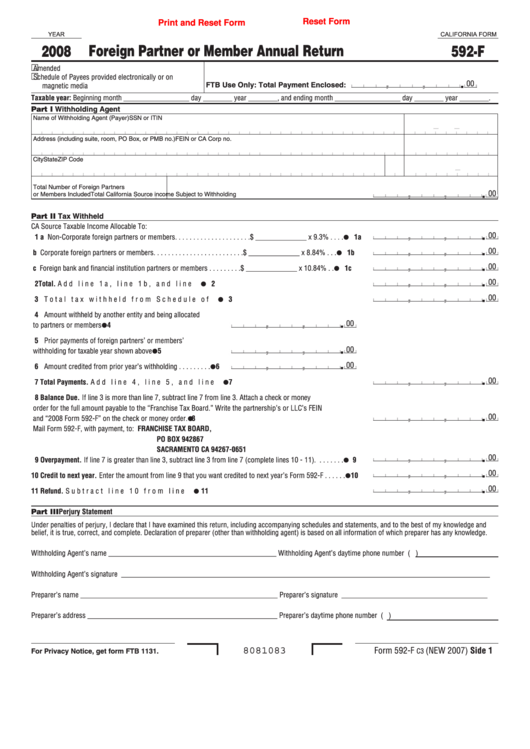

YEAR

CALIFORNIA FORM

Foreign Partner or Member Annual Return

2008

592-F

Amended

Schedule of Payees provided electronically or on

.

00

,

,

FTB Use Only: Total Payment Enclosed:

magnetic media

Taxable year: Beginning month __________________ day ________ year ________, and ending month __________________ day ________ year ________.

Part I Withholding Agent

Name of Withholding Agent (Payer)

SSN or ITIN

Address (including suite, room, PO Box, or PMB no.)

FEIN or CA Corp no.

City

State ZIP Code

Total Number of Foreign Partners

.

00

,

,

or Members Included

Total California Source income Subject to Withholding

Part II Tax Withheld

CA Source Taxable Income Allocable To:

I

.

00

,

,

� a Non-Corporate foreign partners or members. . . . . . . . . . . . . . . . . . . . .$ ______________ x 9.3% . . . .

�a

I

.

,

,

00

b Corporate foreign partners or members. . . . . . . . . . . . . . . . . . . . . . . . .$ ______________ x 8.84% . . .

�b

I

.

00

,

,

c Foreign bank and financial institution partners or members . . . . . . . . .$ ______________ x 10.84% . .

�c

I

.

00

,

,

2 Total. Add line 1a, line 1b, and line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

I

.

00

,

,

3 Total tax withheld from Schedule of Payees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Amount withheld by another entity and being allocated

I

.

00

,

,

to partners or members . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Prior payments of foreign partners’ or members’

I

.

00

,

,

withholding for taxable year shown above . . . . . . . . . . . . .

5

I

.

,

,

00

6 Amount credited from prior year’s withholding . . . . . . . . .

6

I

.

00

,

,

7 Total Payments. Add line 4, line 5, and line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Balance Due. If line 3 is more than line 7, subtract line 7 from line 3. Attach a check or money

order for the full amount payable to the “Franchise Tax Board.” Write the partnership’s or LLC’s FEIN

I

.

,

,

00

and “2008 Form 592-F” on the check or money order. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Mail Form 592-F, with payment, to:

FRANCHISE TAX BOARD,

PO BOX 942867

SACRAMENTO CA 94267-065�

I

.

00

,

,

9 Overpayment. If line 7 is greater than line 3, subtract line 3 from line 7 (complete lines 10 - 11). . . . . . . .

9

.

I

00

,

,

�0 Credit to next year. Enter the amount from line 9 that you want credited to next year’s Form 592-F . . . . . .

�0

.

I

,

00

,

�� Refund. Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

��

Part III Perjury Statement

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer (other than withholding agent) is based on all information of which preparer has any knowledge.

Withholding Agent’s name ______________________________________________

Withholding Agent’s daytime phone number (

)

Withholding Agent’s signature _____________________________________________________________________________________________________

Preparer’s name ______________________________________________________

Preparer’s signature ________________________________________

Preparer’s address ____________________________________________________

Preparer’s daytime phone number (

)

8081083

Form 592-F

(NEW 2007) Side �

C3

For Privacy Notice, get form FTB 1131.

1

1 2

2