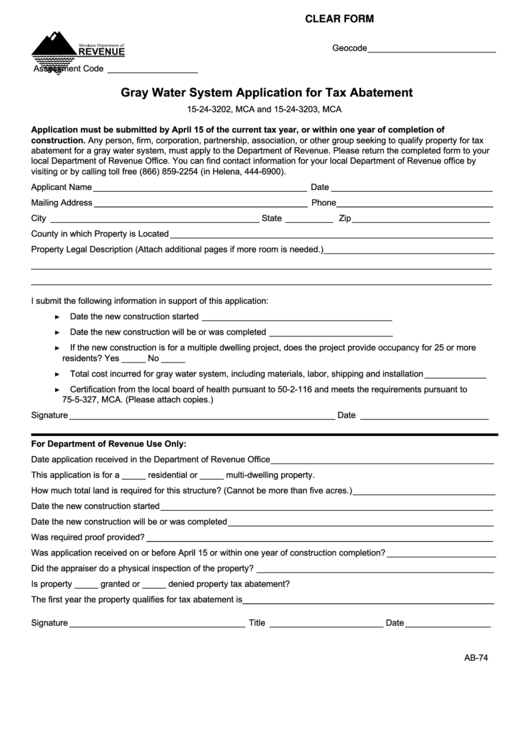

CLEAR FORM

Geocode ___________________________

Assessment Code ___________________

Gray Water System Application for Tax Abatement

15-24-3202, MCA and 15-24-3203, MCA

Application must be submitted by April 15 of the current tax year, or within one year of completion of

construction. Any person, firm, corporation, partnership, association, or other group seeking to qualify property for tax

abatement for a gray water system, must apply to the Department of Revenue. Please return the completed form to your

local Department of Revenue Office. You can find contact information for your local Department of Revenue office by

visiting revenue.mt.gov or by calling toll free (866) 859-2254 (in Helena, 444-6900).

Applicant Name _____________________________________________ Date __________________________________

Mailing Address _____________________________________________ Phone _________________________________

City ____________________________________________ State __________ Zip _____________________________

County in which Property is Located ____________________________________________________________________

Property Legal Description (Attach additional pages if more room is needed.) ____________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

I submit the following information in support of this application:

▶

Date the new construction started ________________________________________

▶

Date the new construction will be or was completed __________________________

▶

If the new construction is for a multiple dwelling project, does the project provide occupancy for 25 or more

residents? Yes _____ No _____

▶

Total cost incurred for gray water system, including materials, labor, shipping and installation _____________

▶

Certification from the local board of health pursuant to 50-2-116 and meets the requirements pursuant to

75-5-327, MCA. (Please attach copies.)

Signature ________________________________________________________ Date ___________________________

For Department of Revenue Use Only:

Date application received in the Department of Revenue Office _______________________________________________

This application is for a _____ residential or _____ multi-dwelling property.

How much total land is required for this structure? (Cannot be more than five acres.) ______________________________

Date the new construction started ______________________________________________________________________

Date the new construction will be or was completed ________________________________________________________

Was required proof provided? _________________________________________________________________________

Was application received on or before April 15 or within one year of construction completion? _______________________

Did the appraiser do a physical inspection of the property? __________________________________________________

Is property _____ granted or _____ denied property tax abatement?

The first year the property qualifies for tax abatement is _____________________________________________________

Signature _____________________________________ Title ________________________ Date __________________

AB-74

1

1