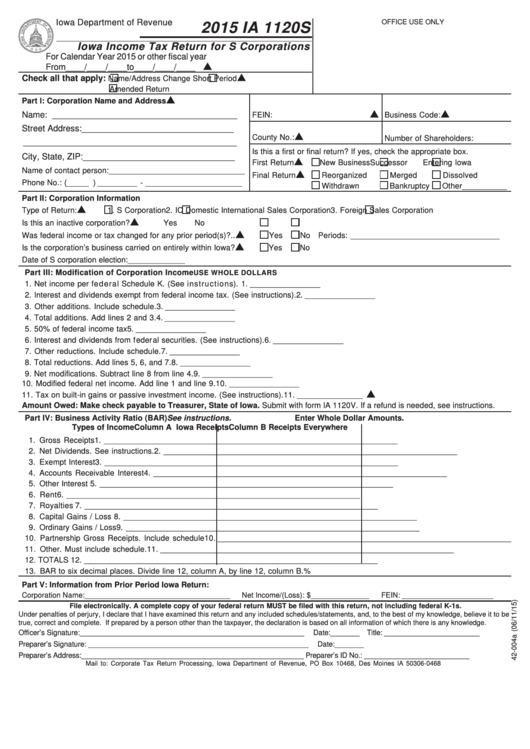

Iowa Department of Revenue

OFFICE USE ONLY

2015 IA 1120S

https://tax.iowa.gov

Iowa Income Tax Return for S Corporations

For Calendar Year 2015 or other fiscal year

L

From____/____/____to____/____/____

L

Check all that apply:

Name/Address Change

Short Period

Amended Return

L

Part I: Corporation Name and Address

L

L

Name: _______________________________________

FEIN:

Business Code:

Street Address: ________________________________

L

County No.:

Number of Shareholders:

_____________________________________________

Is this a first or final return? If yes, check the appropriate box.

City, State, ZIP: ________________________________

L

First Return

New Business

Successor

Entering Iowa

Name of contact person: _______________________________

L

Final Return

Reorganized

Merged

Dissolved

Phone No.: ( _____ ) _________ - ______________________

Withdrawn

Bankruptcy

Other__________

Part II: Corporation Information

L

Type of Return:

1. S Corporation

2. IC Domestic International Sales Corporation

3. Foreign Sales Corporation

L

Is this an inactive corporation? ................................................

Yes

No

L

Was federal income or tax changed for any prior period(s)?..

Yes

No Periods: __________________________________

L

Is the corporation’s business carried on entirely within Iowa?

Yes

No

Date of S corporation election: _____________

Part III: Modification of Corporation Income

USE WHOLE DOLLARS

1. Net income per federal Schedule K. (See instructions). ................................................................................ 1. ________________

2. Interest and dividends exempt from federal income tax. (See instructions). ........... 2. ________________

3. Other additions. Include schedule. ........................................................................... 3. ________________

4. Total additions. Add lines 2 and 3. ........................................................................................................................ 4. ________________

5. 50% of federal income tax ......................................................................................... 5. ________________

6. Interest and dividends from f eder al securities. (See instructions). ......................... 6. ________________

7. Other reductions. Include schedule. ......................................................................... 7. ________________

8. Total reductions. Add lines 5, 6, and 7. ................................................................................................................ 8. ________________

9. Net modifications. Subtract line 8 from line 4. ..................................................................................................... 9. ________________

10. Modified federal net income. Add line 1 and line 9. ............................................................................................ 10. ________________

L

11. Tax on built-in gains or passive investment income. (See instructions). ............................................................ 11. _______________

Amount Owed: Make check payable to Treasurer, State of Iowa. Submit with form IA 1120V. If a refund is needed, see instructions.

Part IV: Business Activity Ratio (BAR) See instructions.

Enter Whole Dollar Amounts.

Types of Income

Column A Iowa Receipts

Column B Receipts Everywhere

1. Gross Receipts ................................................. 1. ___________________________________________________________________

2. Net Dividends. See instructions. ...................... 2. ___________________________________________________________________

3. Exempt Interest ................................................. 3. ___________________________________________________________________

4. Accounts Receivable Interest .......................... 4. ___________________________________________________________________

5. Other Interest .................................................... 5. ___________________________________________________________________

6. Rent ................................................................... 6. ___________________________________________________________________

7. Royalties ........................................................... 7. ___________________________________________________________________

8. Capital Gains / Loss ......................................... 8. ___________________________________________________________________

9. Ordinary Gains / Loss ....................................... 9. ___________________________________________________________________

10. Partnership Gross Receipts. Include schedule10. ___________________________________________________________________

11. Other. Must include schedule. ......................... 11. ___________________________________________________________________

12. TOTALS ............................................................. 12. ___________________________________________________________________

13. BAR to six decimal places. Divide line 12, column A, by line 12, column B.

%

Part V: Information from Prior Period Iowa Return:

Corporation Name: ___________________________________

Net Income/(Loss): $ ______________

FEIN: ______________________

File electronically. A complete copy of your federal return MUST be filed with this return, not including federal K-1s.

Under penalties of perjury, I declare that I have examined this return and any included schedules/statements, and, to the best of my knowledge, believe it to be

true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of which there is any knowledge.

Officer’s Signature: ______________________________________________________

Date: _______ Title: _______________________

Preparer’s Signature: _____________________________________________________

Date: _______

Preparer’s Address:_______________________________________________________ Preparer’s ID No.: __________________________

Mail to: Corporate Tax Return Processing, Iowa Department of Revenue, PO Box 10468, Des Moines IA 50306-0468

1

1 2

2