Pbgc Model Separate Interest Qdro - Qualified Domestic Relations Order

ADVERTISEMENT

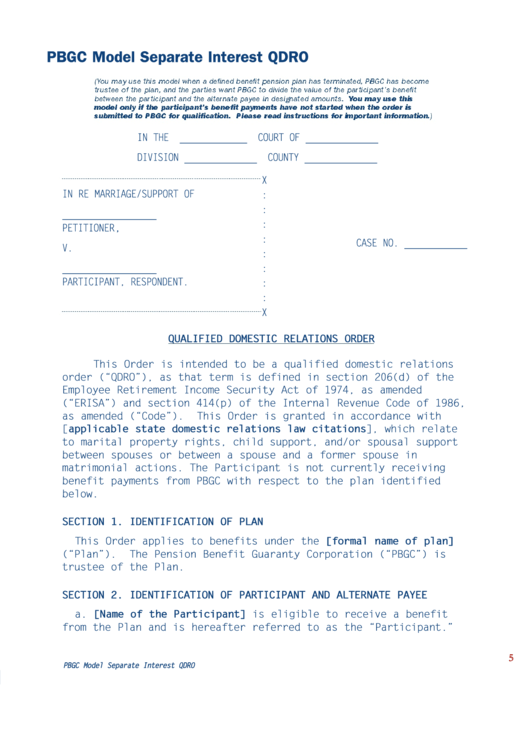

PBGC Model Separate Interest QDRO

(You may use this model when a defined benefit pension plan has terminated, PBGC has become

trustee of the plan, and the parties want PBGC to divide the value of the participant’s benefit

between the participant and the alternate payee in designated amounts. You may use this

model only if the participant’s benefit payments have not started when the order is

submitted to PBGC for qualification. Please read instructions for important information. )

IN THE

_____________

COURT OF ______________

DIVISION ______________

COUNTY ______________

X

IN RE MARRIAGE/SUPPORT OF

:

:

__________________

:

,

PETITIONER

:

CASE NO. ____________

V.

:

__________________

:

PARTICIPANT, RESPONDENT.

:

:

X

QUALIFIED DOMESTIC RELATIONS ORDER

This Order is intended to be a qualified domestic relations

order (“QDRO”), as that term is defined in section 206(d) of the

Employee Retirement Income Security Act of 1974, as amended

(“ERISA”) and section 414(p) of the Internal Revenue Code of 1986,

as amended (“Code”).

This Order is granted in accordance with

[applicable state domestic relations law citations], which relate

to marital property rights, child support, and/or spousal support

between spouses or between a spouse and a former spouse in

matrimonial actions. The Participant is not currently receiving

benefit payments from PBGC with respect to the plan identified

below.

SECTION 1. IDENTIFICATION OF PLAN

This Order applies to benefits under the [formal name of plan]

(“Plan”).

The Pension Benefit Guaranty Corporation (“PBGC”) is

trustee of the Plan.

SECTION 2. IDENTIFICATION OF PARTICIPANT AND ALTERNATE PAYEE

a. [Name of the Participant] is eligible to receive a benefit

from the Plan and is hereafter referred to as the “Participant.”

5

PBGC Model Separate Interest QDRO

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4