Combined City And Borough Sales Tax Report Ketchikan Gateway Borough Form

ADVERTISEMENT

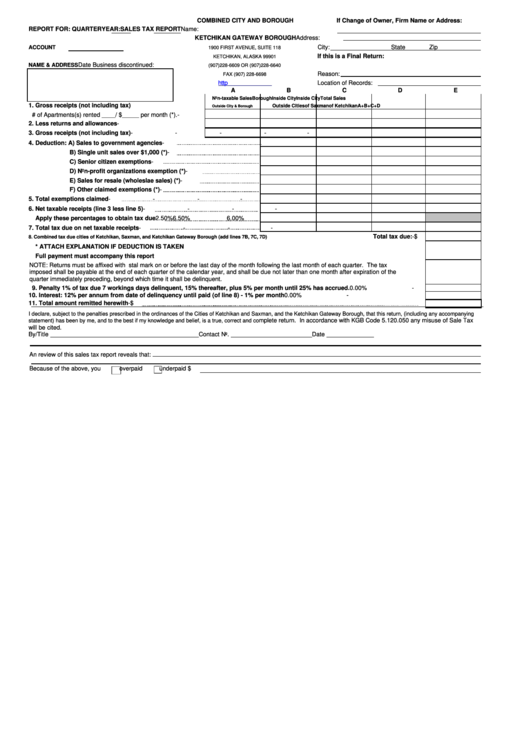

COMBINED CITY AND BOROUGH

If Change of Owner, Firm Name or Address:

REPORT FOR: QUARTER

YEAR:

SALES TAX REPORT

Name:

KETCHIKAN GATEWAY BOROUGH

Address:

City:

State

Zip

ACCOUNT

1900 FIRST AVENUE, SUITE 118

If this is a Final Return:

KETCHIKAN, ALASKA 99901

Date Business discontinued:

NAME & ADDRESS

(907)228-6609 OR (907)228-6640

Reason:

FAX (907) 228-6698

Location of Records:

A

B

C

D

E

Non-taxable Sales

Borough

Inside City

Inside City

Total Sales

1. Gross receipts (not including tax)

Outside Cities

of Saxman

of Ketchikan

A+B+C+D

Outside City & Borough

# of Apartments(s) rented ____/ $_____ per month (*).

-

2. Less returns and allowances

-

3. Gross receipts (not including tax)

-

-

-

-

-

4. Deduction: A) Sales to government agencies

-

B) Single unit sales over $1,000 (*)

-

C) Senior citizen exemptions

-

D) Non-profit organizations exemption (*)

-

E) Sales for resale (wholeslae sales) (*)

-

F) Other claimed exemptions (*)

-

5. Total exemptions claimed

-

-

-

-

6. Net taxable receipts (line 3 less line 5)

-

-

-

-

Apply these percentages to obtain tax due

2.50%

6.50%

6.00%

7. Total tax due on net taxable receipts

-

-

-

-

Total tax due:

$

-

8. Combined tax due cities of Ketchikan, Saxman, and Ketchikan Gateway Borough (add lines 7B, 7C, 7D)

* ATTACH EXPLANATION IF DEDUCTION IS TAKEN

Full payment must accompany this report

NOTE: Returns must be affixed with U.S. Postal mark on or before the last day of the month following the last month of each quarter. The tax

imposed shall be payable at the end of each quarter of the calendar year, and shall be due not later than one month after expiration of the

quarter immediately preceding, beyond which time it shall be delinquent.

9. Penalty 1% of tax due 7 workings days delinquent, 15% thereafter, plus 5% per month until 25% has accrued.

0.00%

-

10. Interest: 12% per annum from date of delinquency until paid (of line 8) - 1% per month

0.00%

-

11. Total amount remitted herewith

$

-

I declare, subject to the penalties prescribed in the ordinances of the Cities of Ketchikan and Saxman, and the Ketchikan Gateway Borough, that this return, (including any accompanying

mplete return. In accordance with KGB Code 5.120.050 any misuse of Sale Tax

statement) has been by me, and to the best if my knowledge and belief, is a true, correct and co

will be cited.

By/Title ____________________________________________Contact No. ________________________Date ______________

An review of this sales tax report reveals that:

Because of the above, you

overpaid

underpaid $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2