Utility Users Tax Remittance Form - City Of Burbank

ADVERTISEMENT

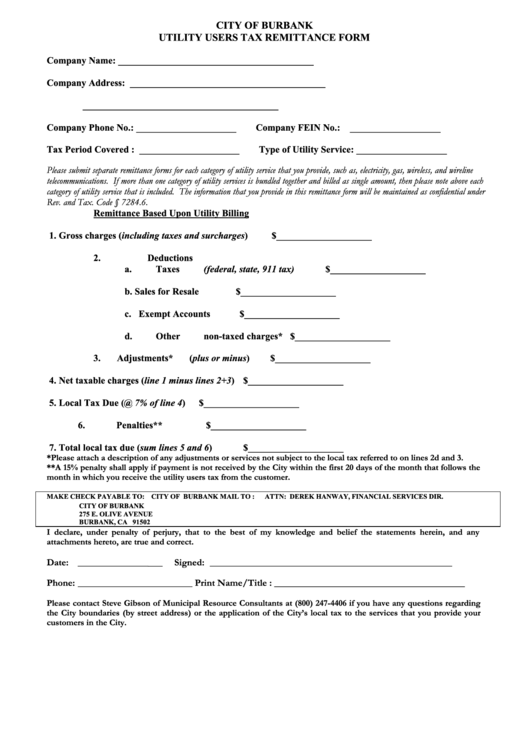

CITY OF BURBANK

UTILITY USERS TAX REMITTANCE FORM

Company Name:

_________________________________________

Company Address:

_________________________________________

_________________________________________

Company Phone No.: _____________________

Company FEIN No.: ___________________

Tax Period Covered : _____________________

Type of Utility Service: ___________________

Please submit separate remittance forms for each category of utility service that you provide, such as, electricity, gas, wireless, and wireline

telecommunications. If more than one category of utility services is bundled together and billed as single amount, then please note above each

category of utility service that is included. The information that you provide in this remittance form will be maintained as confidential under

Rev. and Tax. Code § 7284.6.

Remittance Based Upon Utility Billing

1.

Gross charges (including taxes and surcharges)

$____________________

2.

Deductions

a.

Taxes (federal, state, 911 tax)

$____________________

b.

Sales for Resale

$____________________

c.

Exempt Accounts

$____________________

d.

Other non-taxed charges*

$____________________

3.

Adjustments* (plus or minus)

$____________________

4.

Net taxable charges (line 1 minus lines 2+3)

$____________________

5.

Local Tax Due (@ 7% of line 4)

$____________________

6.

Penalties**

$____________________

7.

Total local tax due (sum lines 5 and 6)

$____________________

*Please attach a description of any adjustments or services not subject to the local tax referred to on lines 2d and 3.

**A 15% penalty shall apply if payment is not received by the City within the first 20 days of the month that follows the

month in which you receive the utility users tax from the customer.

MAKE CHECK PAYABLE TO: CITY OF BURBANK

MAIL TO :

ATTN: DEREK HANWAY, FINANCIAL SERVICES DIR.

CITY OF BURBANK

275 E. OLIVE AVENUE

BURBANK, CA 91502

I declare, under penalty of perjury, that to the best of my knowledge and belief the statements herein, and any

attachments hereto, are true and correct.

Date:

___

Signed:

________________

_______________________________________________________

Phone:

Print Name/Title : ________________________________________

__________________________

Please contact Steve Gibson of Municipal Resource Consultants at (800) 247-4406 if you have any questions regarding

the City boundaries (by street address) or the application of the City’s local tax to the services that you provide your

customers in the City.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1