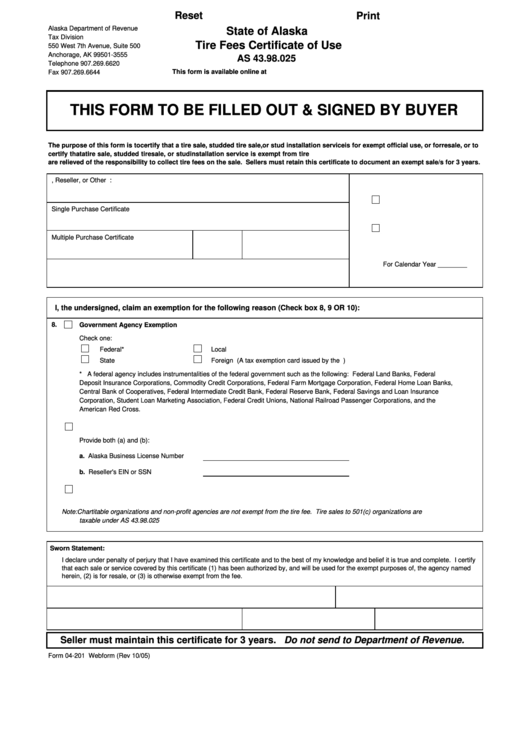

Reset

Print

Alaska Department of Revenue

State of Alaska

Tax Division

Tire Fees Certificate of Use

550 West 7th Avenue, Suite 500

Anchorage, AK 99501-3555

AS 43.98.025

Telephone 907.269.6620

This form is available online at

Fax 907.269.6644

THIS FORM TO BE FILLED OUT & SIGNED BY BUYER

The purpose of this form is to certify that a tire sale, studded tire sale, or stud installation service is for exempt official use, or for resale, or to

certify that a tire sale, studded tire sale, or stud installation service is exempt from tire fees. Sellers who in good faith accept this certificate

are relieved of the responsibility to collect tire fees on the sale. Sellers must retain this certificate to document an exempt sale/s for 3 years.

1. Name of Government Agency, Reseller, or Other Person

2.

Check Applicable Box:

3. Mailing Address

Single Purchase Certificate

4. City

5. State

6. Zip Code

Multiple Purchase Certificate

For Calendar Year ________

7. Telephone Number

I, the undersigned, claim an exemption for the following reason (Check box 8, 9 OR 10):

8.

Government Agency Exemption

Check one:

Federal*

Local

State

Foreign (A tax exemption card issued by the U.S. Department of State is required)

* A federal agency includes instrumentalities of the federal government such as the following: Federal Land Banks, Federal

Deposit Insurance Corporations, Commodity Credit Corporations, Federal Farm Mortgage Corporation, Federal Home Loan Banks,

Central Bank of Cooperatives, Federal Intermediate Credit Bank, Federal Reserve Bank, Federal Savings and Loan Insurance

Corporation, Student Loan Marketing Association, Federal Credit Unions, National Railroad Passenger Corporations, and the

American Red Cross.

9.

Tire Reseller Exemption

Provide both (a) and (b):

a. Alaska Business License Number

b. Reseller's EIN or SSN

10.

Tire designed for highway use to be used on a motor vehicle not designed for highway use

Note: Chartitable organizations and non-profit agencies are not exempt from the tire fee. Tire sales to 501(c) organizations are

taxable under AS 43.98.025

Sworn Statement:

I declare under penalty of perjury that I have examined this certificate and to the best of my knowledge and belief it is true and complete. I certify

that each sale or service covered by this certificate (1) has been authorized by, and will be used for the exempt purposes of, the agency named

herein, (2) is for resale, or (3) is otherwise exempt from the fee.

11. Signature

12. Date

13. Type or Print Name

14. Title

15.

Telephone Number

Seller must maintain this certificate for 3 years. Do not send to Department of Revenue.

Form 04-201 Webform (Rev 10/05)

1

1