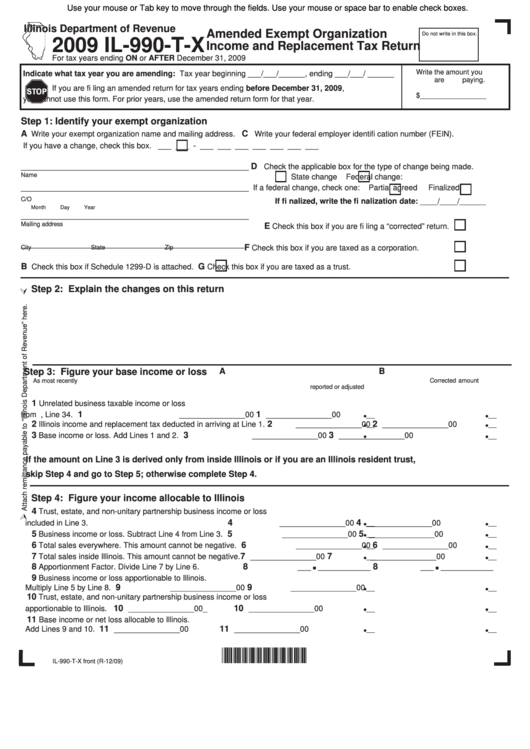

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Amended Exempt Organization

Do not write in this box.

2009 IL-990-T-X

Income and Replacement Tax Return

For tax years ending ON or AFTER December 31, 2009

Write the amount you

Indicate what tax year you are amending: Tax year beginning ___/___/______, ending ___/___/ ______

are paying.

If you are fi ling an amended return for tax years ending before December 31, 2009,

$_________________

you cannot use this form. For prior years, use the amended return form for that year.

Step 1: Identify your exempt organization

A

C

Write your exempt organization name and mailing address.

Write your federal employer identifi cation number (FEIN).

If you have a change, check this box.

___ ___ - ___ ___ ___ ___ ___ ___ ___

D

____________________________________________________

Check the applicable box for the type of change being made.

Name

State change

Federal change:

____________________________________________________

If a federal change, check one:

Partial agreed

Finalized

C/O

If fi nalized, write the fi nalization date: ____/____/______

Month

Day

Year

____________________________________________________

Mailing address

E

Check this box if you

are

fi ling a “corrected” return.

___________________________________________________

F

Check this box if you are taxed as a corporation.

City

State

Zip

B

G

Check this box if Schedule 1299-D is attached.

Check this box if you are taxed as a trust.

Step 2: Explain the changes on this return

A

B

Step 3: Figure your base income or loss

As most recently

Corrected amount

reported or adjusted

1

Unrelated business taxable income or loss

1

1

from U.S. Form 990-T, Line 34.

_______________ 00

_______________ 00

2

2

2

Illinois income and replacement tax deducted in arriving at Line 1.

_______________ 00

_______________ 00

3

3

3

Base income or loss. Add Lines 1 and 2.

_______________ 00

_______________ 00

If the amount on Line 3 is derived only from inside Illinois or if you are an Illinois resident trust,

skip Step 4 and go to Step 5; otherwise complete Step 4.

Step 4: Figure your income allocable to Illinois

4

Trust, estate, and non-unitary partnership business income or loss

4

4

included in Line 3.

_______________ 00

_______________ 00

5

5

5

Business income or loss. Subtract Line 4 from Line 3.

_______________ 00

_______________ 00

6

6

6

Total sales everywhere. This amount cannot be negative.

_______________ 00

_______________ 00

.

.

7

7

7

Total sales inside Illinois. This amount cannot be negative.

_______________ 00

_______________ 00

8

8

8

Apportionment Factor. Divide Line 7 by Line 6.

___

____________

___

____________

9

Business income or loss apportionable to Illinois.

9

9

Multiply Line 5 by Line 8.

_______________ 00

_______________ 00

10

Trust, estate, and non-unitary partnership business income or loss

10

10

apportionable to Illinois.

_______________ 00_

_______________ 00

11

Base income or net loss allocable to Illinois.

11

11

Add Lines 9 and 10.

_______________ 00

_______________ 00

*931801110*

IL-990-T-X front (R-12/09)

1

1 2

2