Print and Reset Form

Reset Form

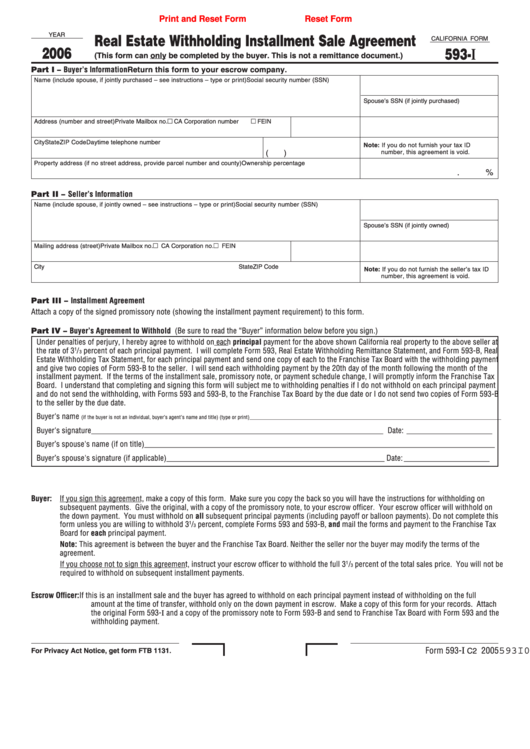

YEAR

Real Estate Withholding Installment Sale Agreement

CALIFORNIA FORM

2006

593-I

(This form can only be completed by the buyer. This is not a remittance document.)

Part I – Buyer’s Information

Return this form to your escrow company.

Name (include spouse, if jointly purchased – see instructions – type or print)

Social security number (SSN)

Spouse’s SSN (if jointly purchased)

Address (number and street)

Private Mailbox no.

CA Corporation number

FEIN

City

State

ZIP Code

Daytime telephone number

Note: If you do not furnish your tax ID

(

)

number, this agreement is void.

Property address (if no street address, provide parcel number and county)

Ownership percentage

.

%

Part II – Seller’s Information

Name (include spouse, if jointly owned – see instructions – type or print)

Social security number (SSN)

Spouse’s SSN (if jointly owned)

Mailing address (street)

Private Mailbox no.

CA Corporation no.

FEIN

City

State

ZIP Code

Note: If you do not furnish the seller’s tax ID

number, this agreement is void.

Part III – Installment Agreement

Attach a copy of the signed promissory note (showing the installment payment requirement) to this form.

Part IV – Buyer’s Agreement to Withhold (Be sure to read the “Buyer” information below before you sign.)

Under penalties of perjury, I hereby agree to withhold on each principal payment for the above shown California real property to the above seller at

the rate of 3

1

/

percent of each principal payment. I will complete Form 593, Real Estate Withholding Remittance Statement, and Form 593-B, Real

3

Estate Withholding Tax Statement, for each principal payment and send one copy of each to the Franchise Tax Board with the withholding payment

and give two copies of Form 593-B to the seller. I will send each withholding payment by the 20th day of the month following the month of the

installment payment. If the terms of the installment sale, promissory note, or payment schedule change, I will promptly inform the Franchise Tax

Board. I understand that completing and signing this form will subject me to withholding penalties if I do not withhold on each principal payment

and do not send the withholding, with Forms 593 and 593-B, to the Franchise Tax Board by the due date or I do not send two copies of Form 593-B

to the seller by the due date.

Buyer's name

(if the buyer is not an individual, buyer’s agent’s name and title) (type or print) ______________________________________________________________________________________________

Buyer's signature ___________________________________________________________________________ Date: ______________________

Buyer’s spouse's name (if on title) __________________________________________________________________________________________

Buyer’s spouse's signature (if applicable) ________________________________________________________ Date: ______________________

Buyer: If you sign this agreement, make a copy of this form. Make sure you copy the back so you will have the instructions for withholding on

subsequent payments. Give the original, with a copy of the promissory note, to your escrow officer. Your escrow officer will withhold on

the down payment. You must withhold on all subsequent principal payments (including payoff or balloon payments). Do not complete this

form unless you are willing to withhold 3

1

/

percent, complete Forms 593 and 593-B, and mail the forms and payment to the Franchise Tax

3

Board for each principal payment.

Note: This agreement is between the buyer and the Franchise Tax Board. Neither the seller nor the buyer may modify the terms of the

agreement.

If you choose not to sign this agreement, instruct your escrow officer to withhold the full 3

1

/

percent of the total sales price. You will not be

3

required to withhold on subsequent installment payments.

Escrow Officer:

If this is an installment sale and the buyer has agreed to withhold on each principal payment instead of withholding on the full

amount at the time of transfer, withhold only on the down payment in escrow. Make a copy of this form for your records. Attach

the original Form 593-I and a copy of the promissory note to Form 593-B and send to Franchise Tax Board with Form 593 and the

withholding payment.

I

593I05103

Form 593-

2005

C2

For Privacy Act Notice, get form FTB 1131.

1

1