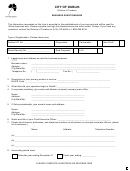

9. Estimated Annual Payroll: _________________ x .02 = _________________ (estimated tax withheld)

Filing will be semi monthly (if income tax withheld is more than $12,000 per year)

Monthly (if income tax withheld is over $1,200 per year but under $12,000 per year)

Quarterly (if income tax withheld is less than $1,200 per year)

10. Please complete the statements below; if applicable:

(A) Number of employees (if sole proprietor do not include yourself)

Full-time: _______ Part-time: _______

(B) Date when employees began working in Dublin

.

(C) _____ We have no employees working in Dublin. We wish to withhold as a courtesy for employees who

live in Dublin starting

.

11. Do you lease business space from others? If so, to whom is rent paid:

Name

Address

City/State/Zip

Telephone No.

Owner:

___________________________________________________________________________________

Agent:

___________________________________________________________________________________

12. Send the net profit tax return to (not applicable for Courtesy Withholders):

Business name:

____________________________________________________________________________

Address:

____________________________________________________________________________

City/State/Zip:

________________________________________ Telephone No. (

) _________________

13. Send withholding report tax form to:

Business name:

____________________________________________________________________________

Address:

____________________________________________________________________________

City/State/Zip:

________________________________________ Telephone No. (

) _________________

14. For Contractors/Sub-Contractors Only:

(A) Are you a general contractor or sub-contractor? _______________________________________________

(B) Location of current job: _____________________________________________________________________

(C) Probable length of job: from: _________ to: _________

Estimated cost of job: ____________________

(D) Will you be doing more than one job in Dublin?

(E) Name and address of party from whom work is contracted:

Name:

____________________________________________________________________________

Address:

____________________________________________________________________________

(F) Will you be sub-contracting any of the work to someone else? If yes, please attach a list with name and

addresses.

15. Does your organization use a payroll service?

If yes, provide name:

.

THE INFORMATION HEREBY SUBMITTED IS TRUE AND CORRECT:

Signature: __________________________________ Date: ___________________

Title:

__________________________________

Company: __________________________________

To avoid delays in processing, please check the information given to verify accuracy and detail. Your

cooperation is appreciated.

REMIT TO:

CITY OF DUBLIN

P.O. Box 9062, Dublin OH 43017-0962 (614) 410-4460 FAX (614) 923-5543

1

1 2

2