Application Form For Refund Of Taxes

ADVERTISEMENT

ALC 80

Rev. 3/01

•

P.O. Box 530

Columbus, OH 43216-0530

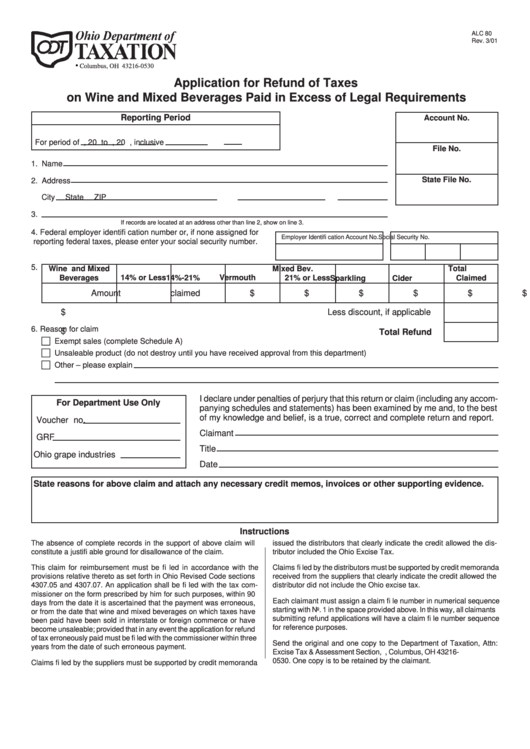

Application for Refund of Taxes

on Wine and Mixed Beverages Paid in Excess of Legal Requirements

Reporting Period

Account No.

For period of

, 20

to

, 20

, inclusive

File No.

1. Name

State File No.

2. Address

City

State

ZIP

3.

If records are located at an address other than line 2, show on line 3.

4. Federal employer identifi cation number or, if none assigned for

Employer Identifi cation Account No.

Social Security No.

reporting federal taxes, please enter your social security number.

5.

Wine and Mixed

Mixed Bev.

Total

14% or Less

Vermouth

Beverages

14%-21%

21% or Less

Claimed

Sparkling

Cider

Amount claimed

$

$

$

$

$

$

$

$

Less discount, if applicable

6. Reason for claim

$

Total Refund

Exempt sales (complete Schedule A)

Unsaleable product (do not destroy until you have received approval from this department)

Other – please explain

I declare under penalties of perjury that this return or claim (including any accom-

For Department Use Only

panying schedules and statements) has been examined by me and, to the best

of my knowledge and belief, is a true, correct and complete return and report.

Voucher no.

Claimant

GRF

Title

Ohio grape industries

Date

State reasons for above claim and attach any necessary credit memos, invoices or other supporting evidence.

Instructions

The absence of complete records in the support of above claim will

issued the distributors that clearly indicate the credit allowed the dis-

constitute a justifi able ground for disallowance of the claim.

tributor included the Ohio Excise Tax.

This claim for reimbursement must be fi led in accordance with the

Claims fi led by the distributors must be supported by credit memoranda

provisions relative thereto as set forth in Ohio Revised Code sections

received from the suppliers that clearly indicate the credit allowed the

4307.05 and 4307.07. An application shall be fi led with the tax com-

distributor did not include the Ohio excise tax.

missioner on the form prescribed by him for such purposes, within 90

Each claimant must assign a claim fi le number in numerical sequence

days from the date it is ascertained that the payment was erroneous,

starting with No. 1 in the space provided above. In this way, all claimants

or from the date that wine and mixed beverages on which taxes have

submitting refund applications will have a claim fi le number sequence

been paid have been sold in interstate or foreign commerce or have

for reference purposes.

become unsaleable; provided that in any event the application for refund

of tax erroneously paid must be fi led with the commissioner within three

Send the original and one copy to the Department of Taxation, Attn:

years from the date of such erroneous payment.

Excise Tax & Assessment Section, P.O. Box 530, Columbus, OH 43216-

0530. One copy is to be retained by the claimant.

Claims fi led by the suppliers must be supported by credit memoranda

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1