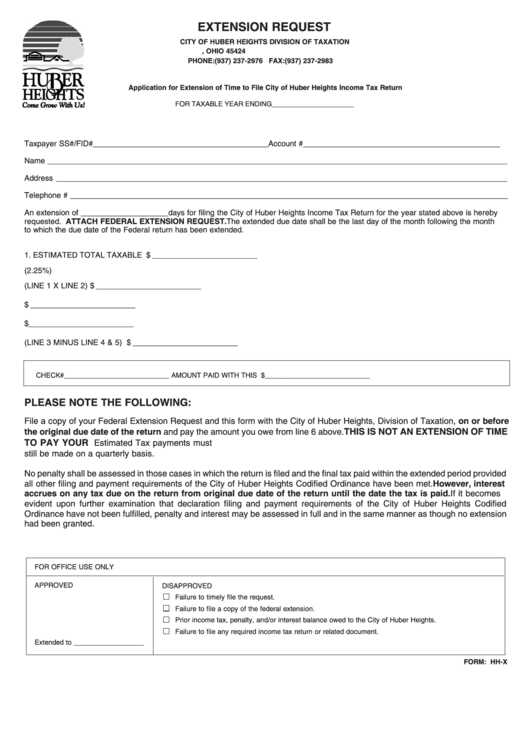

Form: Hh-X - Application For Extension Of Time To File City Of Huber Heights Income Tax Return

ADVERTISEMENT

EXTENSION REQUEST

CITY OF HUBER HEIGHTS DIVISION OF TAXATION

P.O. BOX 24309 DAYTON, OHIO 45424

PHONE: (937) 237-2976 FAX: (937) 237-2983

Application for Extension of Time to File City of Huber Heights Income Tax Return

FOR TAXABLE YEAR ENDING_____________________

Taxpayer SS#/FID# ________________________________________Account # _____________________________________________

Name _________________________________________________________________________________________________________

Address _______________________________________________________________________________________________________

Telephone # ____________________________________________________________________________________________________

An extension of ____________________days for filing the City of Huber Heights Income Tax Return for the year stated above is hereby

requested. ATTACH FEDERAL EXTENSION REQUEST. The extended due date shall be the last day of the month following the month

to which the due date of the Federal return has been extended.

1. ESTIMATED TOTAL TAXABLE INCOME........................................................................................................$ ________________________

2. TAX RATE (2.25%) ...............................................................................................................................................................................x .0225

3. ESTIMATED TAX DUE (LINE 1 X LINE 2) .....................................................................................................$ ________________________

4. CREDIT FOR TAX WITHHELD.......................................................................................................................$ ________________________

5. ESTIMATED PAYMENTS AND/OR PRIOR YEAR OVERPAYMENT .............................................................$ ________________________

6. NET TAX DUE (LINE 3 MINUS LINE 4 & 5) ..................................................................................................$ ________________________

CHECK#___________________________ AMOUNT PAID WITH THIS FORM ..............................................................$___________________________

PLEASE NOTE THE FOLLOWING:

File a copy of your Federal Extension Request and this form with the City of Huber Heights, Division of Taxation, on or before

the original due date of the return and pay the amount you owe from line 6 above. THIS IS NOT AN EXTENSION OF TIME

TO PAY YOUR TAX. EXTENSIONS ARE NOT GRANTED ON AN AUTOMATIC BASIS. Estimated Tax payments must

still be made on a quarterly basis.

No penalty shall be assessed in those cases in which the return is filed and the final tax paid within the extended period provided

all other filing and payment requirements of the City of Huber Heights Codified Ordinance have been met. However, interest

accrues on any tax due on the return from original due date of the return until the date the tax is paid. If it becomes

evident upon further examination that declaration filing and payment requirements of the City of Huber Heights Codified

Ordinance have not been fulfilled, penalty and interest may be assessed in full and in the same manner as though no extension

had been granted.

FOR OFFICE USE ONLY

APPROVED

DISAPPROVED

Failure to timely file the request.

Failure to file a copy of the federal extension.

Prior income tax, penalty, and/or interest balance owed to the City of Huber Heights.

Failure to file any required income tax return or related document.

Extended to __________________

FORM: HH-X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1