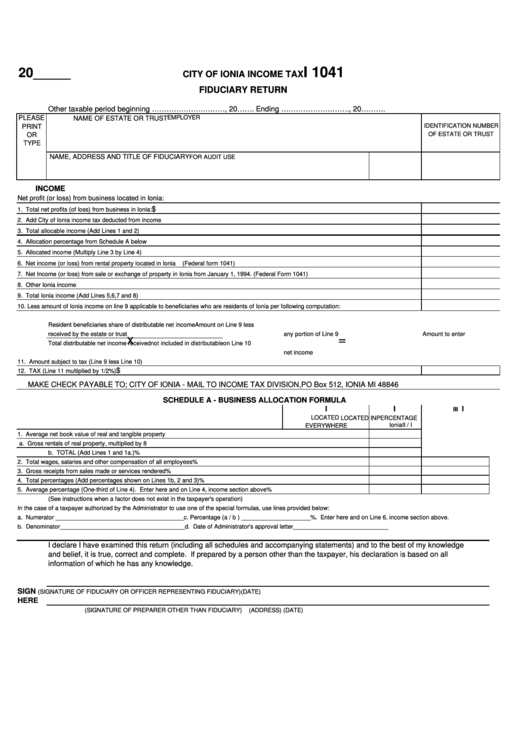

Form I 1041 - Income Tax Fiduciary Return

ADVERTISEMENT

I 1041

20_____

CITY OF IONIA INCOME TAX

FIDUCIARY RETURN

Other taxable period beginning …………………………, 20……. Ending ………………………., 20……….

PLEASE

EMPLOYER

NAME OF ESTATE OR TRUST

PRINT

IDENTIFICATION NUMBER

OF ESTATE OR TRUST

OR

TYPE

NAME, ADDRESS AND TITLE OF FIDUCIARY

FOR AUDIT USE

INCOME

Net profit (or loss) from business located in Ionia:

$

1. Total net profits (of loss) from business in Ionia:

2. Add City of Ionia income tax deducted from income

3. Total allocable income (Add Lines 1 and 2)

4. Allocation percentage from Schedule A below

5. Allocated income (Multiply Line 3 by Line 4)

6. Net income (or loss) from rental property located in Ionia

(Federal form 1041)

7. Net Income (or loss) from sale or exchange of property in Ionia from January 1, 1994. (Federal Form 1041)

8. Other Ionia income

9. Total Ionia income (Add Lines 5,6,7 and 8)

10. Less amount of Ionia income on line 9 applicable to beneficiaries who are residents of Ionia per following computation:

Resident beneficiaries share of distributable net income

Amount on Line 9 less

received by the estate or trust

any portion of Line 9

Amount to enter

x

=

Total distributable net income received

not included in distributable

on Line 10

net income

11. Amount subject to tax (Line 9 less Line 10)

$

12. TAX (Line 11 multiplied by 1/2%)

MAKE CHECK PAYABLE TO; CITY OF IONIA - MAIL TO INCOME TAX DIVISION,PO Box 512, IONIA MI 48846

SCHEDULE A - BUSINESS ALLOCATION FORMULA

I

II

III

LOCATED

LOCATED IN

PERCENTAGE

Ionia

II / I

EVERYWHERE

1. Average net book value of real and tangible property

a. Gross rentals of real property, multiplied by 8

b. TOTAL (Add Lines 1 and 1a.)

%

2. Total wages, salaries and other compensation of all employees

%

3. Gross receipts from sales made or services rendered

%

4. Total percentages (Add percentages shown on Lines 1b, 2 and 3)

%

5. Average percentage (One-third of Line 4). Enter here and on Line 4, income section above

%

(See instructions when a factor does not exist in the taxpayer's operation)

In the case of a taxpayer authorized by the Administrator to use one of the special formulas, use lines provided below:

a. Numerator _______________________________________c. Percentage (a / b ) _____________________%. Enter here and on Line 6, income section above.

b. Denominator______________________________________d. Date of Administrator's approval letter_____________________________

I declare I have examined this return (including all schedules and accompanying statements) and to the best of my knowledge

and belief, it is true, correct and complete. If prepared by a person other than the taxpayer, his declaration is based on all

information of which he has any knowledge.

SIGN

(SIGNATURE OF FIDUCIARY OR OFFICER REPRESENTING FIDUCIARY)

(DATE)

HERE

(SIGNATURE OF PREPARER OTHER THAN FIDUCIARY)

(ADDRESS)

(DATE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2