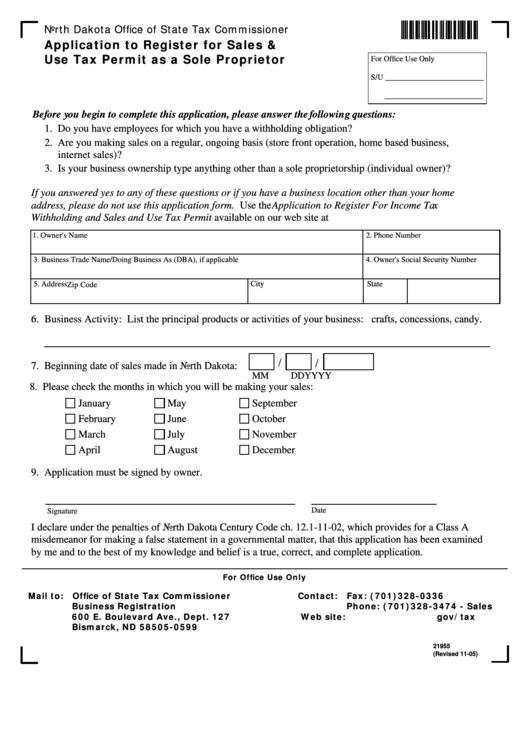

North Dakota Office of State Tax Commissioner

Application to Register for Sales &

Use Tax Permit as a Sole Proprietor

For Office Use Only

S/U _________________________

_________________________

Before you begin to complete this application, please answer the following questions:

1. Do you have employees for which you have a withholding obligation?

2. Are you making sales on a regular, ongoing basis (store front operation, home based business,

internet sales)?

3. Is your business ownership type anything other than a sole proprietorship (individual owner)?

If you answered yes to any of these questions or if you have a business location other than your home

address, please do not use this application form. Use the Application to Register For Income Tax

Withholding and Sales and Use Tax Permit available on our web site at

1. Owner's Name

2. Phone Number

3. Business Trade Name/Doing Business As (DBA), if applicable

4. Owner's Social Security Number

5. Address

City

State

Zip Code

6. Business Activity: List the principal products or activities of your business: i.e. crafts, concessions, candy.

/

/

7. Beginning date of sales made in North Dakota:

MM

DD

YYYY

8. Please check the months in which you will be making your sales:

January

May

September

February

June

October

March

July

November

April

August

December

9. Application must be signed by owner.

Date

Signature

I declare under the penalties of North Dakota Century Code ch. 12.1-11-02, which provides for a Class A

misdemeanor for making a false statement in a governmental matter, that this application has been examined

by me and to the best of my knowledge and belief is a true, correct, and complete application.

For Office Use Only

Mail to: Office of State Tax Commissioner

Contact: Fax: (701)328-0336

Business Registration

Phone: (701)328-3474 - Sales

600 E. Boulevard Ave., Dept. 127

Web site:

Bismarck, ND 58505-0599

21955

(Revised 11-05)

1

1