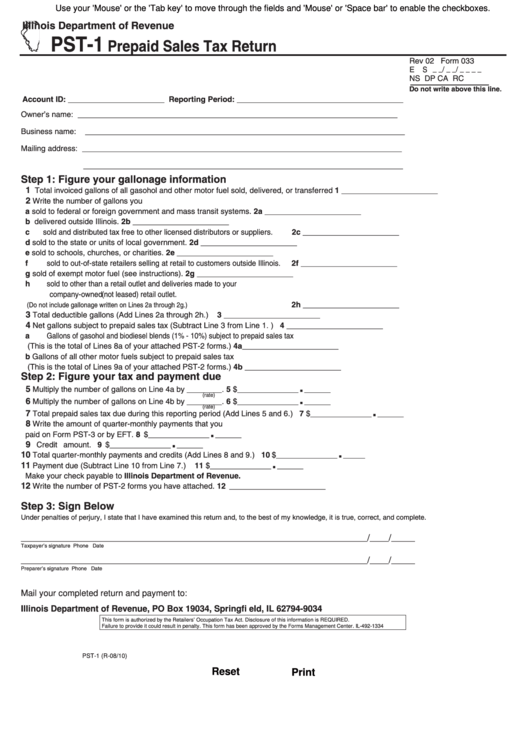

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

PST-1

Prepaid Sales Tax Return

Rev 02 Form 033

E S

_ _/ _ _/ _ _ _ _

NS DP CA RC

Do not write above this line.

Account ID: ______________________ Reporting Period: ______________________________________

Owner’s name:

_________________________________________________________________________

Business name: _________________________________________________________________________

Mailing address: _________________________________________________________________________

_________________________________________________________________________

Step 1: Figure your gallonage information

1

Total invoiced gallons of all gasohol and other motor fuel sold, delivered, or transferred

1 ______________________

2

Write the number of gallons you

a sold to federal or foreign government and mass transit systems.

2a ______________________

b delivered outside Illinois.

2b ______________________

c sold and distributed tax free to other licensed distributors or suppliers.

2c ______________________

d sold to the state or units of local government.

2d ______________________

e sold to schools, churches, or charities.

2e ______________________

f sold to out-of-state retailers selling at retail to customers outside Illinois.

2f ______________________

g sold of exempt motor fuel (see instructions).

2g ______________________

h sold to other than a retail outlet and deliveries made to your

company-owned (not leased) retail outlet.

2h ______________________

(Do not include gallonage written on Lines 2a through 2g.)

3

Total deductible gallons (Add Lines 2a through 2h.)

3 ______________________

4

Net gallons subject to prepaid sales tax (Subtract Line 3 from Line 1. )

4 ______________________

a Gallons of gasohol and biodiesel blends (1% - 10%) subject to prepaid sales tax

(This is the total of Lines 8a of your attached PST-2 forms.)

4a______________________

b Gallons of all other motor fuels subject to prepaid sales tax

(This is the total of Lines 9a of your attached PST-2 forms.)

4b ______________________

Step 2: Figure your tax and payment due

.

5

Multiply the number of gallons on Line 4a by ________.

5 $______________

______

.

(rate)

6

Multiply the number of gallons on Line 4b by ________.

6 $______________

______

.

(rate)

7

Total prepaid sales tax due during this reporting period (Add Lines 5 and 6.)

7 $______________

______

8

Write the amount of quarter-monthly payments that you

.

paid on Form PST-3 or by EFT.

8 $______________

______

.

9

Credit amount.

9 $______________

______

.

10

Total quarter-monthly payments and credits (Add Lines 8 and 9.)

10 $______________

_____

.

11

Payment due (Subtract Line 10 from Line 7.)

11 $______________

______

Make your check payable to Illinois Department of Revenue.

12

Write the number of PST-2 forms you have attached.

12 ______________________

Step 3: Sign Below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_________________________________________________________________________/____/_____

Taxpayer’s signature

Phone

Date

_________________________________________________________________________/____/_____

Preparer’s signature

Phone

Date

Mail your completed return and payment to:

Illinois Department of Revenue, PO Box 19034, Springfi eld, IL 62794-9034

This form is authorized by the Retailers’ Occupation Tax Act. Disclosure of this information is REQUIRED.

Failure to provide it could result in penalty. This form has been approved by the Forms Management Center. IL-492-1334

PST-1 (R-08/10)

Reset

Print

1

1