Print and Reset Form

Reset Form

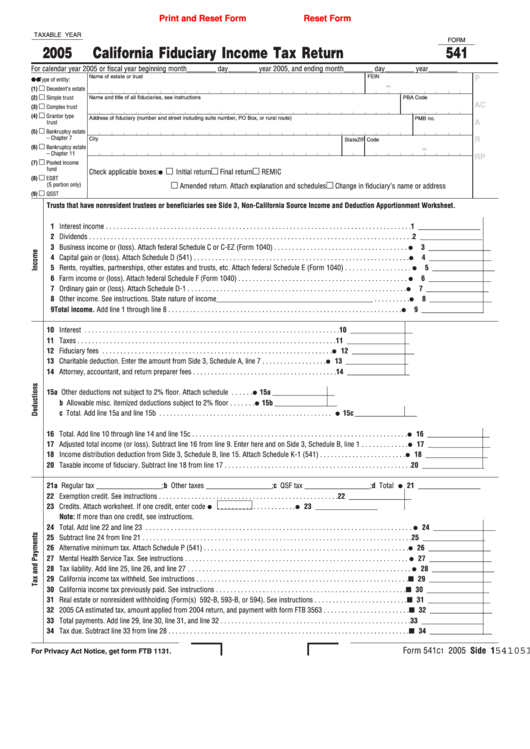

TAXABLE YEAR

FORM

2005

California Fiduciary Income Tax Return

541

For calendar year 2005 or fiscal year beginning month________ day________ year 2005, and ending month________ day________ year________

¼ ¼ ¼ ¼ ¼

Name of estate or trust

FEIN

P

Type of entity:

-

(1)

Decedent’s estate

(2)

Simple trust

Name and title of all fiduciaries, see instructions

PBA Code

AC

(3)

Complex trust

(4)

Grantor type

Address of fiduciary (number and street including suite number, PO Box, or rural route)

PMB no.

A

trust

(5)

Bankruptcy estate

– Chapter 7

City

R

State

ZIP Code

-

(6)

Bankruptcy estate

– Chapter 11

RP

(7)

Pooled income

¼

fund

Check applicable boxes:

Initial return

Final return

REMIC

(8)

ESBT

(S portion only)

Amended return. Attach explanation and schedules

Change in fiduciary’s name or address

(9)

QSST

Trusts that have nonresident trustees or beneficiaries see Side 3, Non-California Source Income and Deduction Apportionment Worksheet.

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 _________________

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 _________________

¼

3 Business income or (loss). Attach federal Schedule C or C-EZ (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 _________________

¼

4 Capital gain or (loss). Attach Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 _________________

¼

5 Rents, royalties, partnerships, other estates and trusts, etc. Attach federal Schedule E (Form 1040) . . . . . . . . . . . . . . . . . .

5 _________________

¼

6 Farm income or (loss). Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 _________________

¼

7 Ordinary gain or (loss). Attach Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 _________________

¼

8 Other income. See instructions. State nature of income___________________________________________ . . . . . . . . . .

8 _________________

¼

9 Total income. Add line 1 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 _________________

_________________

10 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 _________________

11 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 _________________

¼

12 Fiduciary fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 _________________

¼

13 Charitable deduction. Enter the amount from Side 3, Schedule A, line 7 . . . . . . . . . . . . . . . . . .

13 _________________

14 Attorney, accountant, and return preparer fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 _________________

¼

15 a Other deductions not subject to 2% floor. Attach schedule . . . . . .

15a _________________

¼

b Allowable misc. itemized deductions subject to 2% floor . . . . . . .

15b _________________

¼

c Total. Add line 15a and line 15b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15c _________________

¼

16 Total. Add line 10 through line 14 and line 15c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 _________________

¼

17 Adjusted total income (or loss). Subtract line 16 from line 9. Enter here and on Side 3, Schedule B, line 1 . . . . . . . . . . . . .

17 _________________

¼

18 Income distribution deduction from Side 3, Schedule B, line 15. Attach Schedule K-1 (541) . . . . . . . . . . . . . . . . . . . . . . . .

18 _________________

20 Taxable income of fiduciary. Subtract line 18 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 _________________

¼

21 a Regular tax __________________; b Other taxes __________________; c QSF tax __________________; d Total

21 _________________

22 Exemption credit. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 _________________

¼

¼

23 Credits. Attach worksheet. If one credit, enter code

. . . . . . . . . . . . . . . . . . . . . .

23 _________________

Note: If more than one credit, see instructions.

¼

24 Total. Add line 22 and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24 _________________

25 Subtract line 24 from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 _________________

¼

26 Alternative minimum tax. Attach Schedule P (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26 _________________

¼

27 Mental Health Service Tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27 _________________

¼

28 Tax liability. Add line 25, line 26, and line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28 _________________

29 California income tax withheld. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29 _________________

30 California income tax previously paid. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30 _________________

31 Real estate or nonresident withholding (Form(s) 592-B, 593-B, or 594). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . .

31 _________________

32 2005 CA estimated tax, amount applied from 2004 return, and payment with form FTB 3563 . . . . . . . . . . . . . . . . . . . . . . . .

32 _________________

33 Total payments. Add line 29, line 30, line 31, and line 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 _________________

34 Tax due. Subtract line 33 from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34 _________________

54105103

Form 541

2005 Side 1

C1

For Privacy Act Notice, get form FTB 1131.

1

1 2

2 3

3