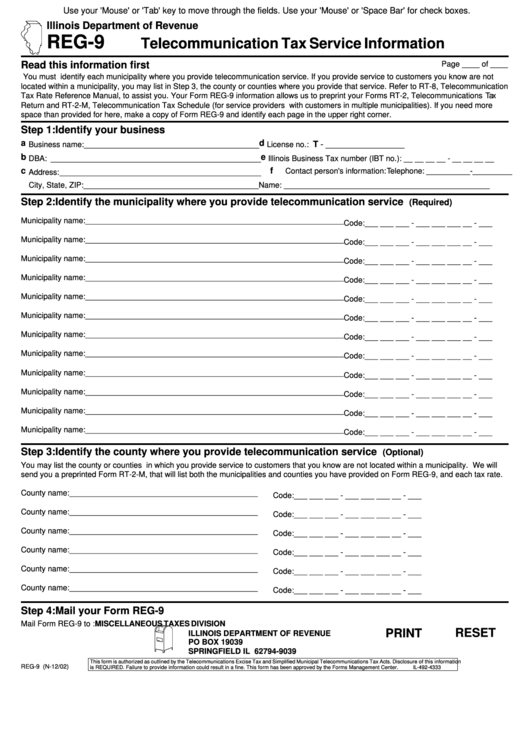

Use your 'Mouse' or 'Tab' key to move through the fields. Use your 'Mouse' or 'Space Bar' for check boxes.

Illinois Department of Revenue

REG-9

Telecommunication Tax Service Information

Read this information first

Page ____ of ____

You must identify each municipality where you provide telecommunication service. If you provide service to customers you know are not

located within a municipality, you may list in Step 3, the county or counties where you provide that service. Refer to RT-8, Telecommunication

Tax Rate Reference Manual, to assist you. Your Form REG-9 information allows us to preprint your Forms RT-2, Telecommunications Tax

Return and RT-2-M, Telecommunication Tax Schedule (for service providers with customers in multiple municipalities). If you need more

space than provided for here, make a copy of Form REG-9 and identify each page in the upper right corner.

Step 1:

Identify your business

a

d

T -

Business name: ________________________________________

License no.:

__________________

b

e

DBA: ________________________________________________

Illinois Business Tax number (IBT no.): __ __ __ __ - __ __ __ __

c

f

Contact person's information: Telephone: __________-_________

Address:______________________________________________

City, State, ZIP: ________________________________________

Name: _______________________________________________

Step 2:

Identify the municipality where you provide telecommunication service

(Required)

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Municipality name: ___________________________________________________________

Code: ___ ___ ___ - ___ ___ ___ __ - ___

Step 3:

Identify the county where you provide telecommunication service

(Optional)

You may list the county or counties in which you provide service to customers that you know are not located within a municipality. We will

send you a preprinted Form RT-2-M, that will list both the municipalities and counties you have provided on Form REG-9, and each tax rate.

County name:___________________________________________

Code:___ ___ ___ - ___ ___ ___ __ - ___

County name:___________________________________________

Code:___ ___ ___ - ___ ___ ___ __ - ___

County name:___________________________________________

Code:___ ___ ___ - ___ ___ ___ __ - ___

County name:___________________________________________

Code:___ ___ ___ - ___ ___ ___ __ - ___

County name:___________________________________________

Code:___ ___ ___ - ___ ___ ___ __ - ___

County name:___________________________________________

Code:___ ___ ___ - ___ ___ ___ __ - ___

Step 4:

Mail your Form REG-9

Mail Form REG-9 to :

MISCELLANEOUS TAXES DIVISION

RESET

PRINT

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19039

SPRINGFIELD IL 62794-9039

This form is authorized as outlined by the Telecommunications Excise Tax and Simplified Municipal Telecommunications Tax Acts. Disclosure of this information

REG-9 (N-12/02)

is REQUIRED. Failure to provide information could result in a fine. This form has been approved by the Forms Management Center.

IL-492-4333

1

1