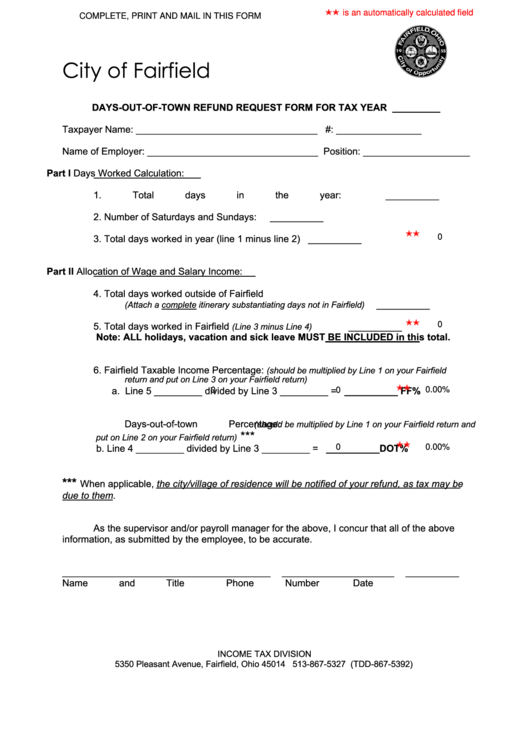

is an automatically calculated field

COMPLETE, PRINT AND MAIL IN THIS FORM

City of Fairfield

DAYS-OUT-OF-TOWN REFUND REQUEST FORM FOR TAX YEAR _________

Taxpayer Name: __________________________________ S.S. #: ________________

Name of Employer: ________________________________ Position: ____________________

Part I

Days Worked Calculation:

1.

Total days in the year:

__________

2.

Number of Saturdays and Sundays:

__________

0

3.

Total days worked in year (line 1 minus line 2)

__________

Part II

Allocation of Wage and Salary Income:

4.

Total days worked outside of Fairfield

__________

(Attach a complete itinerary substantiating days not in Fairfield)

0

5.

Total days worked in Fairfield

__________

(Line 3 minus Line 4)

Note: ALL holidays, vacation and sick leave MUST BE INCLUDED in this total.

6.

Fairfield Taxable Income Percentage:

(should be multiplied by Line 1 on your Fairfield

return and put on Line 3 on your Fairfield return)

a.

Line 5 _________ divided by Line 3 _________ =

__________ FF%

0.00%

0

0

Days-out-of-town Percentage:

(should be multiplied by Line 1 on your Fairfield return and

***

put on Line 2 on your Fairfield return)

b.

Line 4 _________ divided by Line 3 _________ =

0

__________DOT%

0.00%

***

When applicable, the city/village of residence will be notified of your refund, as tax may be

due to them.

As the supervisor and/or payroll manager for the above, I concur that all of the above

information, as submitted by the employee, to be accurate.

_______________________________________

_____________________

__________

Name and Title

Phone Number

Date

INCOME TAX DIVISION

5350 Pleasant Avenue, Fairfield, Ohio 45014 513-867-5327 (TDD-867-5392)

1

1