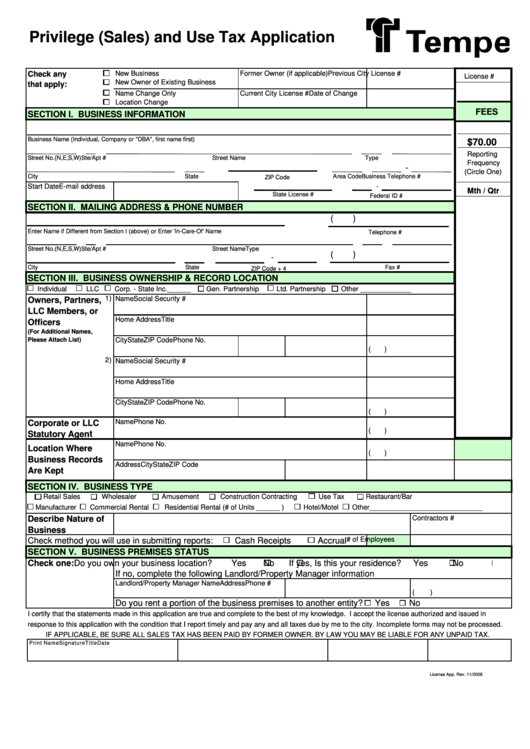

Privilege (Sales) and Use Tax Application

New Business

Former Owner (if applicable)

Previous City License #

Check any

License #

New Owner of Existing Business

that apply:

Name Change Only

Current City License #

Date of Change

Location Change

FEES

SECTION I. BUSINESS INFORMATION

Business Name (Individual, Company or "DBA", first name first)

$70.00

Reporting

Street No.

(N,E,S,W)

Street Name

Type

Ste/Apt #

Frequency

-

(Circle One)

City

State

Area Code

Business Telephone #

ZIP Code

Start Date

E-mail address

-

Mth / Qtr

State License #

Federal ID #

SECTION II. MAILING ADDRESS & PHONE NUMBER

(

)

Enter Name if Different from Section I (above) or Enter 'In-Care-Of' Name

Telephone #

Street No.

(N,E,S,W)

Street Name

Type

Ste/Apt #

(

)

-

City

State

Fax #

ZIP Code + 4

SECTION III. BUSINESS OWNERSHIP & RECORD LOCATION

Individual

LLC

Corp. - State Inc.______

Gen. Partnership

Ltd. Partnership

Other _____________

1)

Name

Social Security #

Owners, Partners,

LLC Members, or

Home Address

Title

Officers

(For Additional Names,

Please Attach List)

City

State

ZIP Code

Phone No.

(

)

2)

Name

Social Security #

Home Address

Title

City

State

ZIP Code

Phone No.

(

)

Name

Phone No.

Corporate or LLC

(

)

Statutory Agent

Name

Phone No.

Location Where

(

)

Business Records

Address

City

State

ZIP Code

Are Kept

SECTION IV. BUSINESS TYPE

Retail Sales

Wholesaler

Amusement

Construction Contracting

Use Tax

Restaurant/Bar

Manufacturer

Commercial Rental

Residential Rental (# of Units ______ )

Hotel/Motel

Other_____________________________

Describe Nature of

Contractors #

Business

# of Employees

Check method you will use in submitting reports:

Cash Receipts

Accrual

SECTION V. BUSINESS PREMISES STATUS

Check one:

Do you own your business location?

Yes

No

If yes, Is this your residence?

Yes

No

If no, complete the following Landlord/Property Manager information

Landlord/Property Manager Name

Address

Phone #

(

)

Do you rent a portion of the business premises to another entity?

Yes

No

I certify that the statements made in this application are true and complete to the best of my knowledge. I accept the license authorized and issued in

response to this application with the condition that I report timely and pay any and all taxes due by me to the city. Incomplete forms may not be processed.

IF APPLICABLE, BE SURE ALL SALES TAX HAS BEEN PAID BY FORMER OWNER. BY LAW YOU MAY BE LIABLE FOR ANY UNPAID TAX.

Print Name

Signature

Title

Date

License App. Rev. 11/2008

1

1 2

2 3

3