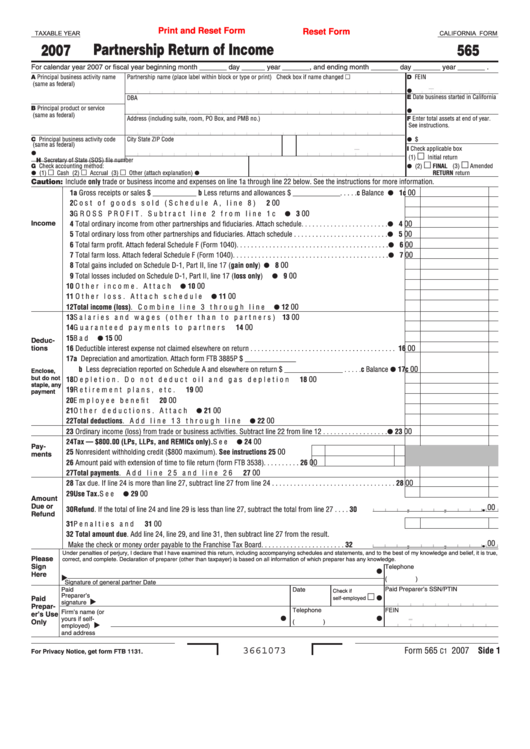

Print and Reset Form

Reset Form

TAXABLE YEAR

CALIFORNIA FORM

Partnership Return of Income

2007

565

For calendar year 2007 or fiscal year beginning month _______ day ______ year _______, and ending month _______ day _______ year _______ .

A principal business activity name

partnership name (place label within block or type or print)

Check box if name changed

D FEiN

(same as federal)

E Date business started in California

DBA

B principal product or service

(same as federal)

Address (including suite, room, po Box, and pMB no .)

F Enter total assets at end of year .

See instructions .

C principal business activity code

City

State Zip Code

$

(same as federal)

I Check applicable box

(1)

initial return

H Secretary of State (SoS) file number

G Check accounting method:

(2)

FINAL

(3)

Amended

(1)

Cash

(2)

Accrual

(3)

other (attach explanation)

RETURN

return

Caution: include only trade or business income and expenses on line 1a through line 22 below . See the instructions for more information .

00

� a Gross receipts or sales $ ____________ b Less returns and allowances $ _____________ . . . . . c Balance

�c

00

2 Cost of goods sold (Schedule A, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 GroSS proFit . Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

Income

00

4 total ordinary income from other partnerships and fiduciaries . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 total ordinary loss from other partnerships and fiduciaries . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 total farm profit . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 total farm loss . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

00

8 total gains included on Schedule D-1, part ii, line 17 (gain only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 total losses included on Schedule D-1, part ii, line 17 (loss only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

�0 other income . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �0

�� other loss . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ��

00

00

�2 Total income (loss) . Combine line 3 through line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �2

00

�3 Salaries and wages (other than to partners) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�3

00

�4 Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�4

�5 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �5

00

Deduc-

00

tions

�6 Deductible interest expense not claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�6

�7 a Depreciation and amortization . Attach form FtB 3885p $ ______________

00

b Less depreciation reported on Schedule A and elsewhere on return $ ________________ . . . . . c Balance �7c

Enclose,

but do not

�8 Depletion . Do not deduct oil and gas depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�8

00

staple, any

00

�9 retirement plans, etc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�9

payment

00

20 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

2� other deductions . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2�

22 Total deductions . Add line 13 through line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

00

23 ordinary income (loss) from trade or business activities . Subtract line 22 from line 12 . . . . . . . . . . . . . . . . . . 23

00

00

24 Tax — $800.00 (LPs, LLPs, and REMICs only). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Pay-

00

25 Nonresident withholding credit ($800 maximum) . See instructions . . . . . . . . .

25

ments

26 Amount paid with extension of time to file return (form FtB 3538) . . . . . . . . . .

26

00

00

27 Total payments . Add line 25 and line 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

28 tax due . if line 24 is more than line 27, subtract line 27 from line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

00

29 Use Tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Amount

Due or

.

00

,

,

30 Refund . if the total of line 24 and line 29 is less than line 27, subtract the total from line 27 . . . . 30

Refund

00

3� penalties and interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3�

32 Total amount due . Add line 24, line 29, and line 31, then subtract line 27 from the result .

.

00

,

,

Make the check or money order payable to the Franchise tax Board . . . . . . . . . . . . . . . . . . . . . . . 32

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

Please

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Telephone

Here

(

)

Signature of general partner

Date

Paid Preparer’s SSN/PTIN

Paid

Date

Check if

Preparer’s

Paid

self-employed

signature

Prepar-

Telephone

FEIN

Firm’s name (or

-

er’s Use

yours if self-

Only

(

)

employed)

and address

Form 565

2007 Side �

3661073

C1

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3 4

4