Instructions For Form Nyc-Htx - Hotel Tax Quarterly Return

ADVERTISEMENT

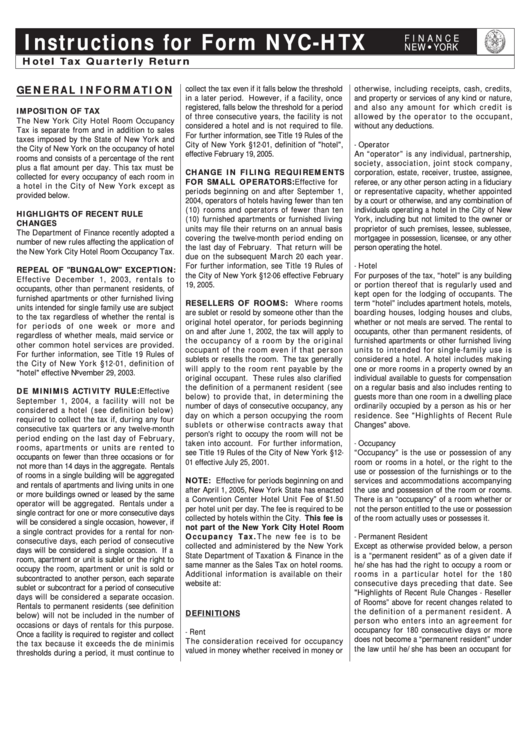

Instr uctions for For m NYC-HTX

F I N A N C E

NEW YORK

H o t e l T a x Q u a r t e r l y R e t u r n

collect the tax even if it falls below the threshold

otherwise, including receipts, cash, credits,

GE N E R A L IN F O R M A T I O N

in a later period. However, if a facility, once

and property or services of any kind or nature,

registered, falls below the threshold for a period

and also any amount for which credit is

IMPOSITION OF TAX

of three consecutive years, the facility is not

allowed by the operator to the occupant,

The New York City Hotel Room Occupancy

considered a hotel and is not required to file.

without any deductions.

Tax is separate from and in addition to sales

For further information, see Title 19 Rules of the

taxes imposed by the State of New York and

City of New York §12-01, definition of "hotel",

- Operator

the City of New York on the occupancy of hotel

effective February 19, 2005.

An “operator” is any individual, partnership,

rooms and consists of a percentage of the rent

society, association, joint stock company,

plus a flat amount per day. This tax must be

CHANGE IN FILING REQUIREMENTS

corporation, estate, receiver, trustee, assignee,

collected for every occupancy of each room in

FOR SMALL OPERATORS: Effective for

referee, or any other person acting in a fiduciary

a hotel in the City of New York except as

periods beginning on and after September 1,

or representative capacity, whether appointed

provided below.

2004, operators of hotels having fewer than ten

by a court or otherwise, and any combination of

(10) rooms and operators of fewer than ten

individuals operating a hotel in the City of New

HIGHLIGHTS OF RECENT RULE

(10) furnished apartments or furnished living

York, including but not limited to the owner or

CHANGES

units may file their returns on an annual basis

proprietor of such premises, lessee, sublessee,

The Department of Finance recently adopted a

covering the twelve-month period ending on

mortgagee in possession, licensee, or any other

number of new rules affecting the application of

the last day of February. That return will be

person operating the hotel.

the New York City Hotel Room Occupancy Tax.

due on the subsequent March 20 each year.

For further information, see Title 19 Rules of

- Hotel

REPEAL OF "BUNGALOW" EXCEPTION:

the City of New York §12-06 effective February

For purposes of the tax, “hotel” is any building

Effective December 1, 2003, rentals to

19, 2005.

or portion thereof that is regularly used and

occupants, other than permanent residents, of

kept open for the lodging of occupants. The

furnished apartments or other furnished living

RESELLERS OF ROOMS: Where rooms

term “hotel” includes apartment hotels, motels,

units intended for single family use are subject

are sublet or resold by someone other than the

boarding houses, lodging houses and clubs,

to the tax regardless of whether the rental is

original hotel operator, for periods beginning

whether or not meals are served. The rental to

for periods of one week or more and

on and after June 1, 2002, the tax will apply to

occupants, other than permanent residents, of

regardless of whether meals, maid service or

the occupancy of a room by the original

furnished apartments or other furnished living

other common hotel services are provided.

occupant of the room even if that person

units to intended for single-family use is

For further information, see Title 19 Rules of

sublets or resells the room. The tax generally

considered a hotel. A hotel includes making

the City of New York §12-01, definition of

will apply to the room rent payable by the

one or more rooms in a property owned by an

"hotel" effective November 29, 2003.

original occupant. These rules also clarified

individual available to guests for compensation

the definition of a permanent resident (see

on a regular basis and also includes renting to

DE MINIMIS ACTIVITY RULE: Effective

below) to provide that, in determining the

guests more than one room in a dwelling place

September 1, 2004, a facility will not be

number of days of consecutive occupancy, any

ordinarily occupied by a person as his or her

considered a hotel (see definition below)

day on which a person occupying the room

residence. See "Highlights of Recent Rule

required to collect the tax if, during any four

sublets or otherwise contracts away that

Changes" above.

consecutive tax quarters or any twelve-month

person's right to occupy the room will not be

period ending on the last day of February,

taken into account. For further information,

- Occupancy

rooms, apartments or units are rented to

see Title 19 Rules of the City of New York §12-

“Occupancy” is the use or possession of any

occupants on fewer than three occasions or for

01 effective July 25, 2001.

room or rooms in a hotel, or the right to the

not more than 14 days in the aggregate. Rentals

use or possession of the furnishings or to the

of rooms in a single building will be aggregated

NOTE: Effective for periods beginning on and

services and accommodations accompanying

and rentals of apartments and living units in one

after April 1, 2005, New York State has enacted

the use and possession of the room or rooms.

or more buildings owned or leased by the same

a Convention Center Hotel Unit Fee of $1.50

There is an “occupancy” of a room whether or

operator will be aggregated. Rentals under a

per hotel unit per day. The fee is required to be

not the person entitled to the use or possession

single contract for one or more consecutive days

collected by hotels within the City. This fee is

of the room actually uses or possesses it.

will be considered a single occasion, however, if

not part of the New York City Hotel Room

a single contract provides for a rental for non-

Occupancy Tax. The new fee is to be

- Permanent Resident

consecutive days, each period of consecutive

collected and administered by the New York

Except as otherwise provided below, a person

days will be considered a single occasion. If a

State Department of Taxation & Finance in the

is a “permanent resident” as of a given date if

room, apartment or unit is sublet or the right to

same manner as the Sales Tax on hotel rooms.

he/she has had the right to occupy a room or

occupy the room, apartment or unit is sold or

Additional information is available on their

rooms in a particular hotel for the 180

subcontracted to another person, each separate

website at:

consecutive days preceding that date. See

sublet or subcontract for a period of consecutive

"Highlights of Recent Rule Changes - Reseller

days will be considered a separate occasion.

of Rooms” above for recent changes related to

Rentals to permanent residents (see definition

the definition of a permanent resident. A

DEFINITIONS

below) will not be included in the number of

person who enters into an agreement for

occasions or days of rentals for this purpose.

occupancy for 180 consecutive days or more

- Rent

Once a facility is required to register and collect

does not become a “permanent resident” under

The consideration received for occupancy

the tax because it exceeds the de minimis

the law until he/she has been an occupant for

valued in money whether received in money or

thresholds during a period, it must continue to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3