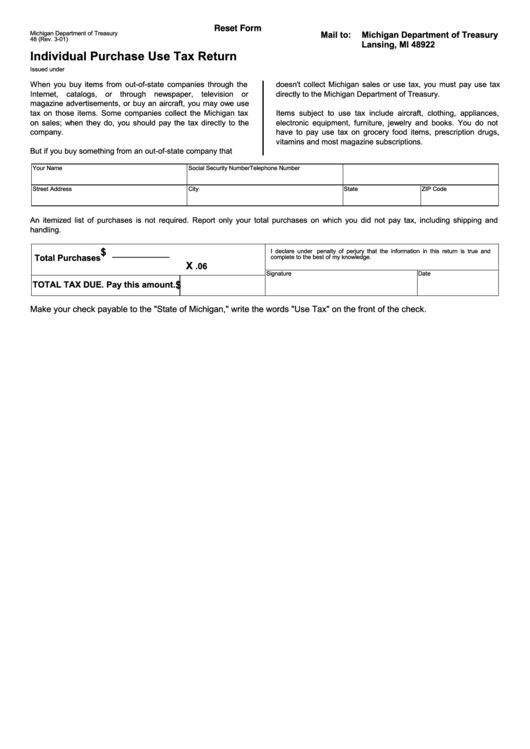

Reset Form

Michigan Department of Treasury

Mail to:

Michigan Department of Treasury

48 (Rev. 3-01)

Lansing, MI 48922

Individual Purchase Use Tax Return

Issued under P.A. 94 of 1937. Filing is mandatory.

When you buy items from out-of-state companies through the

doesn't collect Michigan sales or use tax, you must pay use tax

Internet, catalogs, or through newspaper, television or

directly to the Michigan Department of Treasury.

magazine advertisements, or buy an aircraft, you may owe use

tax on those items. Some companies collect the Michigan tax

Items subject to use tax include aircraft, clothing, appliances,

on sales; when they do, you should pay the tax directly to the

electronic equipment, furniture, jewelry and books. You do not

company.

have to pay use tax on grocery food items, prescription drugs,

vitamins and most magazine subscriptions.

But if you buy something from an out-of-state company that

Your Name

Social Security Number

Telephone Number

Street Address

City

State

ZIP Code

An itemized list of purchases is not required. Report only your total purchases on which you did not pay tax, including shipping and

handling.

$ __________

I declare under penalty of perjury that the information in this return is true and

Total Purchases

complete to the best of my knowledge.

X

.06

Signature

Date

$

TOTAL TAX DUE. Pay this amount.

Make your check payable to the "State of Michigan," write the words "Use Tax" on the front of the check.

1

1