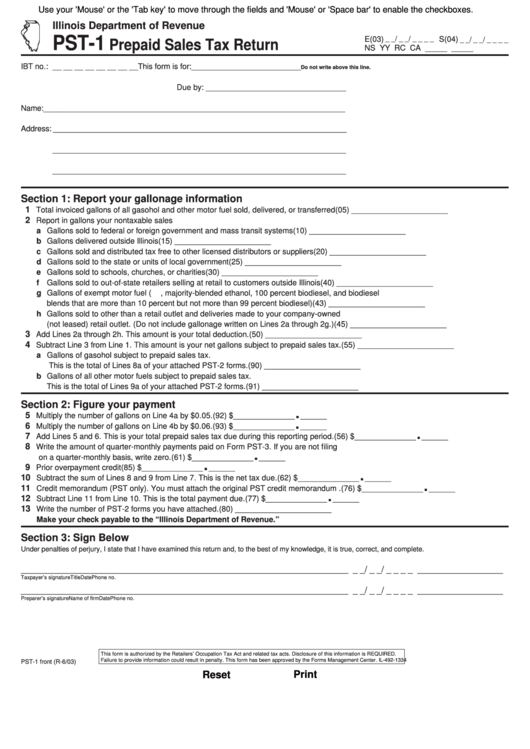

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

PST-1

E(03)

S(04)

_ _/ _ _/ _ _ _ _

_ _/ _ _/ _ _ _ _

Prepaid Sales Tax Return

NS YY RC CA _____ _____

IBT no.: __ __ __ __ __ __ __ __

This form is for: _________________________

Do not write above this line.

Due by: ________________________________

Name: _____________________________________________________________________

Address: ___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

Section 1: Report your gallonage information

1

Total invoiced gallons of all gasohol and other motor fuel sold, delivered, or transferred

(05) ______________________

2

Report in gallons your nontaxable sales

a Gallons sold to federal or foreign government and mass transit systems

(10) ______________________

b Gallons delivered outside Illinois

(15) ______________________

c Gallons sold and distributed tax free to other licensed distributors or suppliers

(20) ______________________

d Gallons sold to the state or units of local government

(25) ______________________

e Gallons sold to schools, churches, or charities

(30) ______________________

f Gallons sold to out-of-state retailers selling at retail to customers outside Illinois

(40) ______________________

g Gallons of exempt motor fuel ( i.e. , majority-blended ethanol, 100 percent biodiesel, and biodiesel

blends that are more than 10 percent but not more than 99 percent biodiesel)

(43) ______________________

h Gallons sold to other than a retail outlet and deliveries made to your company-owned

(not leased) retail outlet. (Do not include gallonage written on Lines 2a through 2g.)

(45) ______________________

3

Add Lines 2a through 2h. This amount is your total deduction.

(50) ______________________

4

Subtract Line 3 from Line 1. This amount is your net gallons subject to prepaid sales tax.

(55) ______________________

a Gallons of gasohol subject to prepaid sales tax.

This is the total of Lines 8a of your attached PST-2 forms.

(90) ______________________

b Gallons of all other motor fuels subject to prepaid sales tax.

This is the total of Lines 9a of your attached PST-2 forms.

(91) ______________________

Section 2: Figure your payment

.

5

Multiply the number of gallons on Line 4a by $0.05.

(92) $______________

______

.

6

Multiply the number of gallons on Line 4b by $0.06.

(93) $______________

______

.

7

Add Lines 5 and 6. This is your total prepaid sales tax due during this reporting period.

(56) $______________

______

8

Write the amount of quarter-monthly payments paid on Form PST-3. If you are not filing

.

on a quarter-monthly basis, write zero.

(61) $______________

______

.

9

Prior overpayment credit

(85) $______________

______

.

10

Subtract the sum of Lines 8 and 9 from Line 7. This is the net tax due.

(62) $______________

______

.

11

Credit memorandum (PST only). You must attach the original PST credit memorandum .

(76) $______________

______

.

12

Subtract Line 11 from Line 10. This is the total payment due.

(77) $______________

______

13

Write the number of PST-2 forms you have attached.

(80) ______________________

Make your check payable to the “Illinois Department of Revenue.”

Section 3: Sign Below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________________________________________________ _ _/ _ _/ _ _ _ _ __________________

Taxpayer’s signature

Title

Date

Phone no.

_____________________________________________________________________ _ _/ _ _/ _ _ _ _ __________________

Preparer’s signature

Name of firm

Date

Phone no.

This form is authorized by the Retailers’ Occupation Tax Act and related tax acts. Disclosure of this information is REQUIRED.

Failure to provide information could result in penalty. This form has been approved by the Forms Management Center. IL-492-1334

PST-1 front (R-6/03)

Reset

Print

1

1