Student Credit Form - City Of Green, Ohio Division Of Taxation

ADVERTISEMENT

Click Here & Upgrade

Expanded Features

PDF

Unlimited Pages

Documents

Complete

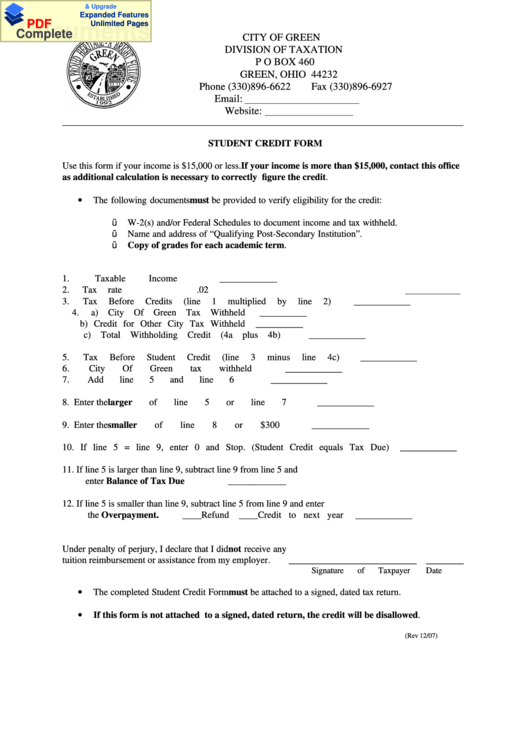

CITY OF GREEN

DIVISION OF TAXATION

P O BOX 460

GREEN, OHIO 44232

Phone (330)896-6622

Fax (330)896-6927

Email:

Website:

____________________________________________________________________________________________

STUDENT CREDIT FORM

Use this form if your income is $15,000 or less. If your income is more than $15,000, contact this office

as additional calculation is necessary to correctly figure the credit.

•

The following documents must be provided to verify eligibility for the credit:

ü W-2(s) and/or Federal Schedules to document income and tax withheld.

ü Name and address of “Qualifying Post-Secondary Institution”.

ü Copy of grades for each academic term.

1. Taxable Income

____________

2. Tax rate

.02

3. Tax Before Credits (line 1 multiplied by line 2)

____________

4. a) City Of Green Tax Withheld

__________

b) Credit for Other City Tax Withheld

__________

c) Total Withholding Credit (4a plus 4b)

____________

5. Tax Before Student Credit (line 3 minus line 4c)

____________

6. City Of Green tax withheld

____________

7. Add line 5 and line 6

____________

8. Enter the larger of line 5 or line 7

____________

9. Enter the smaller of line 8 or $300

____________

10. If line 5 = line 9, enter 0 and Stop. (Student Credit equals Tax Due)

____________

11. If line 5 is larger than line 9, subtract line 9 from line 5 and

enter Balance of Tax Due

____________

12. If line 5 is smaller than line 9, subtract line 5 from line 9 and enter

the Overpayment.

____Refund ____Credit to next year

____________

Under penalty of perjury, I declare that I did not receive any

tuition reimbursement or assistance from my employer.

___________________________ ________

Signature of Taxpayer

Date

•

The completed Student Credit Form must be attached to a signed, dated tax return.

•

If this form is not attached to a signed, dated return, the credit will be disallowed.

(Rev 12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2