01-136

PRINT FORM

CLEAR FIELDS

(Rev.8-12/6)

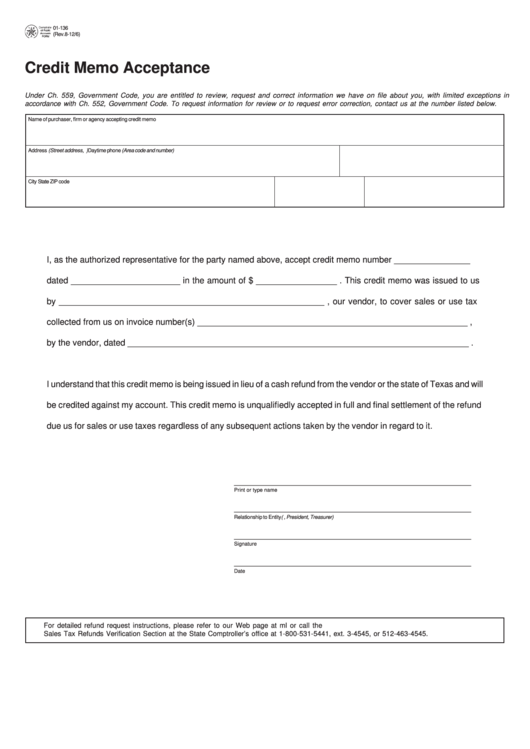

Credit Memo Acceptance

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in

accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the number listed below.

Name of purchaser, firm or agency accepting credit memo

Address (Street address, P.O. Box or Route number)

Daytime phone (Area code and number)

City

State

ZIP code

I, as the authorized representative for the party named above, accept credit memo number ________________

dated _______________________ in the amount of $ _________________ . This credit memo was issued to us

by ________________________________________________________ , our vendor, to cover sales or use tax

collected from us on invoice number(s) _________________________________________________________ ,

by the vendor, dated ________________________________________________________________________ .

I understand that this credit memo is being issued in lieu of a cash refund from the vendor or the state of Texas and will

be credited against my account. This credit memo is unqualifiedly accepted in full and final settlement of the refund

due us for sales or use taxes regardless of any subsequent actions taken by the vendor in regard to it.

__________________________________________________

Print or type name

__________________________________________________

Relationship to Entity (e.g., President, Treasurer)

__________________________________________________

Signature

__________________________________________________

Date

For detailed refund request instructions, please refer to our Web page at or call the

Sales Tax Refunds Verification Section at the State Comptroller’s office at 1-800-531-5441, ext. 3-4545, or 512-463-4545.

1

1