Municipal Non-Property Sales (Option) Tax Form - City Of Stanley

ADVERTISEMENT

C

S

I T Y

O F

T A N L E Y

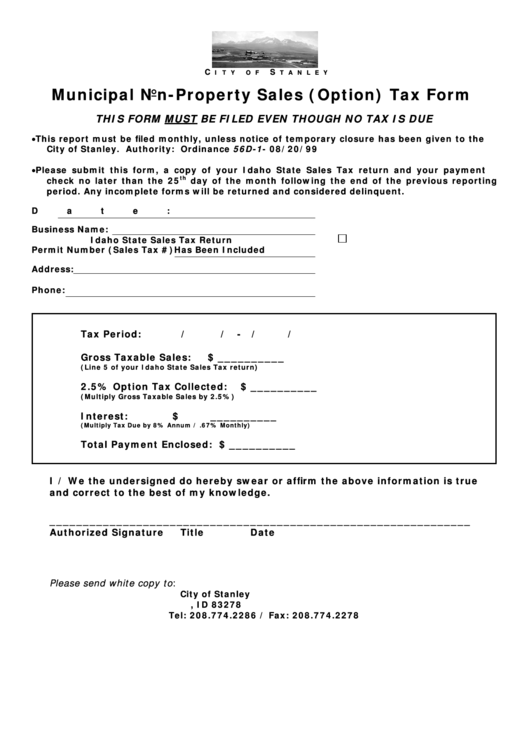

Municipal Non-Property Sales (Option) Tax Form

THIS FORM MUST BE FILED EVEN THOUGH NO TAX IS DUE

•

This report must be filed monthly, unless notice of temporary closure has been given to the

City of Stanley. Authority: Ordinance 56D-1- 08/20/99

•

Please submit this form, a copy of your Idaho State Sales Tax return and your payment

th

check no later than the 25

day of the month following the end of the previous reporting

period. Any incomplete forms will be returned and considered delinquent.

Date:

Business Name:

Idaho State Sales Tax Return

Permit Number (Sales Tax #)

Has Been Included

Address:

Phone:

Tax Period:

/

/

-

/

/

Gross Taxable Sales:

$ __________

(Line 5 of your Idaho State Sales Tax return)

2.5% Option Tax Collected:

$ __________

(Multiply Gross Taxable Sales by 2.5%)

Interest:

$ __________

(Multiply Tax Due by 8% Annum / .67% Monthly)

Total Payment Enclosed:

$ __________

I / We the undersigned do hereby swear or affirm the above information is true

and correct to the best of my knowledge.

_______________________________________________________________

Authorized Signature

Title

Date

Please send white copy to:

City of Stanley

P.O. Box 53 Stanley, ID 83278

Tel: 208.774.2286 / Fax: 208.774.2278

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1